With 500 comments on the last one, a new month, a new season and a new Snapshot day upon us, I thought it was time for a fresh thread.

A few people have asked me about Snapshot day. Was it yesterday, at €984, or today, at €953? I should say that I don't put much stock in the middle quarters because they often show volatility that is not present when you only look at the major quarters. That said, Snapshot day is, in fact, this Friday, Oct. 4th. And MTM Party day is next Wednesday, Oct. 9th.

I'll show you what I mean about volatility when including every quarter. The first chart is only the annual snapshots since 2004, except for the last one on the chart which was mid-year at June 28, 2013. Aside from 2013 so far, it is a nice smooth trendline:

This second one is all of the mid-year and year-end snapshots only:

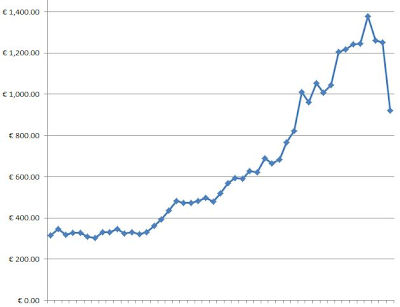

And this third chart includes every single quarterly snapshot since the end of 2001. Notice how bumpy it can be on shorter time frames:

Here's the data for all of the quarterly snapshots since Q4 2001:

2001 Q4 € 314.99

2002 Q1 € 347.32

2002 Q2 € 319.85

2002 Q3 € 326.98

2002 Q4 € 326.83

2003 Q1 € 307.80

2003 Q2 € 302.05

2003 Q3 € 329.99

2003 Q4 € 330.36

2004 Q1 € 346.04

2004 Q2 € 323.94

2004 Q3 € 332.30

2004 Q4 € 321.56

2005 Q1 € 329.76

2005 Q2 € 361.23

2005 Q3 € 393.12

2005 Q4 € 434.86

2006 Q1 € 482.49

2006 Q2 € 472.27

2006 Q3 € 474.00

2006 Q4 € 482.69

2007 Q1 € 498.20

2007 Q2 € 480.19

2007 Q3 € 520.31

2007 Q4 € 568.24

2008 Q1 € 592.75

2008 Q2 € 591.70

2008 Q3 € 627.14

2008 Q4 € 621.54

2009 Q1 € 690.19

2009 Q2 € 665.77

2009 Q3 € 683.77

2009 Q4 € 766.35

2010 Q1 € 823.13

2010 Q2 € 1,010.92

2010 Q3 € 960.58

2010 Q4 € 1,055.42

2011 Q1 € 1,007.25

2011 Q2 € 1,043.38

2011 Q3 € 1,206.40

2011 Q4 € 1,216.86

2012 Q1 € 1,243.45

2012 Q2 € 1,246.62

2012 Q3 € 1,377.42

2012 Q4 € 1,261.18

2013 Q1 € 1,251.46

2013 Q2 € 919.92

As I write this, euro gold is at €951.66. Yesterday it was as high as €989. In fact, there was a €30 swing between the AM and PM fixes today. That's some volatility!

So what's your guess? What do you think will be this quarter's snapshot to be revealed on Oct. 9? Will it be over or under €919.92? Obviously the odds favor over, but as it stands right now we are only €31.74 away from the June low, and it dropped by that much today alone! Anyone brave enough to guess under?

This is, of course, just for fun, because I don't assign much significance to a 3rd quarter snapshot either way. But I am curious to see your guesses! :D

Sincerely,

FOFOA

And since Depeche Mode is currently touring the U.S., here's an appropriate tune that I enjoy:

It's Just a Question of Time!

221 comments:

«Oldest ‹Older 201 – 221 of 221Edit: That is "low or no taxation of private gold bullion sales" . Governments could very well expand the taxes on mine production as mentioned recently in

Glimpsing 3

And argued over in the comment section seemingly for years hehe.

This is why it's a good idea to read the FOFOA posts, they are carefully written (and entertaining!).

Hi T au

I agree with Karen Hudes when she says things that agree with freegold, but then what would I know heh.

Cheers

BH

Alex,

FOFOA and others have predicted that there would be no taxation in a freegold system. However, I will point out that current law in the U.S. imposes capital gains taxes on a sale of gold. That is the law until it is changed. FOFOA and others are predicting that the law will change.

Compare that to other countries like the U.K. where the sale of sovereigns under existing law does not trigger any U.K. capital gains tax.

Given that it takes time to change the law, I think all things being equal it is better to be a U.K. citizen sitting on a pile of sovereigns in the U.K. rather than a U.S. citizen sitting on a pile of Eagles in the U.S. For someone thinking about selling part of the stash immediately post-freegold, that is.

@ T au

Hello Tom, very nice to see you here, old friend.

@ Alex, only certain criteria require 1099B IRS reporting. Here is a brief summary:

- Gold bars greater than 1kg (32.15oz)

- Gold 1 oz Maple Leaf (25x 1oz)

- Gold 1 oz Krugerrand (25x 1oz)

- Gold 1 oz Onza (25x 1oz)

* These requirements DO NOT apply for American Gold Eagles, American Buffalo, Austrian, Australian (Perth Mint Coins), Chinese or any fractional bullion gold coins.

Here is the link I got the info from and where you can learn more: https://www.texmetals.com/sell-gold-coins/

Another reason to deal locally and have a relationship with a dealer.

@ Grumps

I really do hesitate to give you any attention – however, in this case I will.

Since I have begun reading and studying FOFOA’s blog a while back, every damn time I come across your posts, I get this vision of a sinking ship. In the general panic, there are a few people calmly directing folks who will listen to an available life boat.

And then there you are, imploring everyone to come with you to listen to the pretty music the ship’s band is playing. Well, by all means Grumps, do go ahead and pull up a deck chair and listen away while the pretty music still plays.

http://www.youtube.com/watch?v=pj-1b1Yvep8

But you keep attempting to trip others on their way to the life boat - that really pisses me off.

In fact, it pisses me off so much that I’m now going to slap the yellow Donate bitch button and cool down.

@ John

Happy to be here.

Beer Holiday, Robert and Gull Man,

Thank you all very much. I will read all of the links, think about your resposnes and hopefully ease my mind.

There have been many numbers put around on what the cost of mining is these days. I noticed a massive resistance around 1300$/oz., is the market giving a clear hint in that regard?

And what next? Will it break like we most agree? Silently, or in another short-term waterfall fractal? Given the current state of affairs I'd favor the latter.

BEST COUNTRIES TO STORE YOUR GOLD:

What are the best countries to hold gold in other than the U.S. taking into account, storage, taxation, safety etc.? This may have been discussed many times, but circumstances change and maybe a refresher is in order.

If confiscation is not an issue, why do you need to store your gold in another country?

Alex- I prefer China.

Problem is I never get there. I dig deep, and deeper yet, but give up after a while and decide to leave it there to mark my spot.

Careful JoJo, some industrious Chinese is going to dig 'down' to your marker.

gull_mann:

That information that you got off of texmetals.com is in regards to the reporting requirements imposed by the IRS on dealers. If you sell over 25 maples to the dealer, then the dealer is mandated by law to report that transaction to the IRS. But all that is independent of your obligations as a taxpayer to report and pay taxes. So you may sell 24 maples to a dealer, and the dealer won't report that to the IRS (or he might, who knows), but that doesn't exempt you from your obligation to report the profit as a capital gain when you file your taxes.

I have a very hard time picturing a US Congress changing the law such that capital gains on gold sales would become tax-free.

Depends on how desperately they need your gold to flow, to give their currency any value.

"we thought it worth pointing out that, for the last month, US Treasury bonds have become more volatile (more risky) than Italian and Spanish bonds." (ZH)

Finally, signs of discovery in a functionally recovering free market.

Franco

It would have to be a whole new world for Congress to do anything different...but...in a world where gold has a new role, Congress would be hard pressed not to do what the rest of the world is doing in terms of gold. After the dollar dies many things will change.

@ Michael dV and DP

I agree, whether the tax treatment "evolves" will all depend upon then perceived need. After all, there is currently a well established capital gains tax on stocks....but yet when the services of one Henry Paulson were needed to "fix" the financial crisis, he was offered the Treas Sec'y job with the carrot that he could sell his Goldman Sachs stock (about $500 million worth) free of capital gains.....so in the patriotic interest of his country he agreed to serve....and then proceeded to put in "the fix" to his fellow citizens.

Is it too late to nominate FOFOA as Fed Head??

Maybe the counrty could offer him a deal on his golden nuggets......

So, did I miss 3rd qtr snapshot ??

(Dam, I can't do anything right)

Franco: "I have a very hard time picturing a US Congress changing the law such that capital gains on gold sales would become tax-free."

The moment Congress 'realizes' gold miners must be taxed differently a new law will be passed and attached to the new tax code will be the elimination of capital gains taxes on the sale of gold.

Lots of assumptions on what Congress might or might not do. One of those things we will just have to wait and see when we get there.

Post a Comment

Comments are set on moderate, so they may or may not get through.