FOA (06/12/01; 11:23:21MT - usagold.com msg#77)

“Onward

By now everyone should understand that for every dollar that can be bet on a rising price of “paper gold”; three dollars can be made available to create and sell them the other side of that bet. When the big political moves come later and change our currency game, therefore our gold pricing game, this very same fiat contract creating ability will stand against your receiving the later value of physical gold. As expressed in a paper price.

Truly, the market is not manipulated so much as it has found a short term opposing balance. A timely political balance that has used this unlimited fiat creation as the gold price controller. A force being used to smooth a transition from one currency to another. Gold Bugs use this very same fiat creation to buy long “fiat gold contracts” and then complain because the banking reserve system, we all use can do the same. These “Anti Gold Bug” traders can create and supply just as much fiat power to sell us gold as we can use it to buy gold. Then when our futures / paper price remains the same and it’s a cabal killing us. Actually, it’s the modern Gold Bug’s desire to shun physical gold ownership that’s killing him as that desire was discovered and exploited for political means. It’s free enterprise,,,,, Gold Bugs created a demand for something paper and a paper supply creation is delivered.

I marvel at how advocates of paper investing spend their time trying to determine when someone is going to buy up and corner this kind of paper market. Forget it, it’s not going to happen. No one can force a paper market that has unlimited creation potential. And only a fool would try to demand delivery of a good he doesn’t have the assets to pay for,,,,,, and do it in a market he knows doesn’t have the metal to deliver. I know this, you know this, the government knows this and the Giants know it. Far better to just keep buying gold that will one day be correctly valued when this market’s political use is done. So, have you somewhat positioned yourself for the great cornering of this “gold printing press”,,,,, or are you more smartly playing the Kings game?

Climbing now

So what are we looking for when I watch the paper gold prices and comex? What gets me excited when the market begins a little move? Well, it’s not the fact that it’s going up, rather we are looking to see if the impact of political change is working the gold derivative’s credibility yet? I am looking for some wild spurt of trading that lasts for several days or weeks. Open interest rapidly surging hundreds of thousands of contracts, then just as fast plunging away. A paper gold market, containing tremendous price changes ($100++ or more per day, both up and down) that begin to call into question the ability of Comex to function. Not so much question it’s function as an price setting exchange, rather question if it can later function at all in the metal settlement process.

Where the big positions on the opposite side of the longs (shorts) find themselves in a changing world market without physical supply,,,, at almost any price. Brought on by a currency transition. Where big physical bullion dealings (one tonne ++) between real buyers and sellers,,,, outside and away from the exchanges,,,,, begins to run at a huge premiums to our contract based paper trades. Perhaps hundreds of dollars or percent higher,,,,, even impacting the ebb and flow in the coins world as misguided investors quickly sell for profits only to find no market goods later at twice the price.

In this environment, the big shorts on all paper based exchanges will be selling these new “cash created contracts” to the very limits of their capital. And trust me, they will not reach those limits because an unlimited amount of credit will be made available to them. Remember,,,,, for them,,,,, regardless of the supply,,,, the demand,,,, or the price of physical traded metal,,,, as long as the paper contract price doesn’t close “up” too much,,,,, there is no risk or call on their capital. They can just keep on selling.

But, eventually (perhaps over only one day!) the outside the exchange demand for physical and it’s escalating premium, will most likely see legal force from their physical buyers driving long players to demand delivery. Even if it cannot be delivered. Long,,,,,, longggggg,,,, before these delivery demands ever fully surface, comex will state position limits, cash settlement and trade for liquidation only. For you new people, this is exactly what they did during the Hunt silver fiasco. They have to do this because the articles these exchanges were created under manifest these trading places as price setting and price hedging establishments. Where the greatest majority of their trading is meant for cash contract settlement, not physical delivery settlement.

In this light, only Gold Advocates understand that default on Comex is really the forced non metal settlement of a contract at a contrived paper price. A price far below the physical traded price. Most likely a last day of trading price that settles out hundreds of percent below the world price for physical metal trading,,,,,, as it appears the very next day.

And from Jim Sinclair and Trader Dan, this:

Dear Comrades In Golden Arms,

Taking delivery is one thing, but leaving the delivery at the COMEX is another. Leaving the gold at the COMEX warehouse does something but NOT MUCH. In order to level the playing field you must take the delivery OUT OF the COMEX warehouse.

Do not for a moment buy the disinformation that if you take delivery of a 100 ounce gold bar from the COMEX that is has to be re-assayed to sell it. That is DISINFORMATION as it is a COMEX rule put in to dissuade you from, taking delivery out of the warehouse. You get to register bars by serial number in COMEX delivery exactly how you would get from any international bank. Those bars, after examination, will not be questioned in the selling process away from the COMEX.

I am giving you today the cost of storage of gold at the Zurich Airport Free Zone in SEGREGATED FORM. A German Bank purchased this depository with offices in Switzerland. After having checked every international storage point for you, the charges are reasonable. Shipping it there is totally legal. Having valuables in a safe depository is not having a foreign account. Please confirm that point with your tax or general attorney.

You will shortly get the cost of shipment and insurance by Brinks or a similarly rated shipper of valuable as soon as I am able to compare charges to see you are treated as any other professional would be.

Jim,

I called Tom Kelly whom I spoke with this morning at Brink's regarding storage. I spoke with him to get information just on transport to and from as follows:

NY to Zurich - he would need to have the exact business info/addresses for to and from locations. Each sealed package/container must not exceed 50-60 pounds and you would need to advise them how many there are. You need to submit this to them via email and it takes a few days to get a response.

Dar-Zurich - he would need to contact their offices with the above information and to get clarification on whether they could actually transport the gold.

Regards,

CIGA Anna

Jim Sinclair's Commentary

With this information you need not place a financial intermediary between you and your gold. You do not need to buy certificated gold in Australia or send any money to a website.

You handle the entire situation yourself with the help of JB. I will be teaching JB how to see that the gold is properly transferred from COMEX delivery to the shipper, making your life even easier. JB has promised me that he will not solicit your business in speculative dealings but simply aid you in taking delivery and shipping to an international depository where it will be held in segregated form.

Don't think for a moment that using Australia or the Internet offers you any privacy because if the boys want to know you can be sure the records of an Australian, Canadian or US website can be secured by the proper authority or for that matter any authority today.

I believe in doing things in the light of day.

Please be assured I have no financial relationship with either the depository, the bank that owns it or CIGA JB Slear, either directly or indirectly.

Anyone wishing a sworn affidavit concerning the above will receive it.

Trader Dan says:

The more buyers that can be recruited to this effort, particularly buyers of large size, the more difficult the life of the paper shorts will become. Short of taking delivery of the actual metal, preferably pulling it out of the warehouses, the shorts can reign supreme over this market. What's more - they are doing this with impunity as they pay no price financially to do so and profit quite handsomely I might add. Strip them of the metal and they are cooked. Then they will have to compete on a level playing field like the rest of us. Who was it that said, "He who sells what isn't his'n, must pay the price or go to prison"? If the paper shorts are selling what doesn't exist, namely tons of actual gold, forcing them to show us the actual metal will work to modify their behavior. This is the only way to keep the Comex gold market honest.

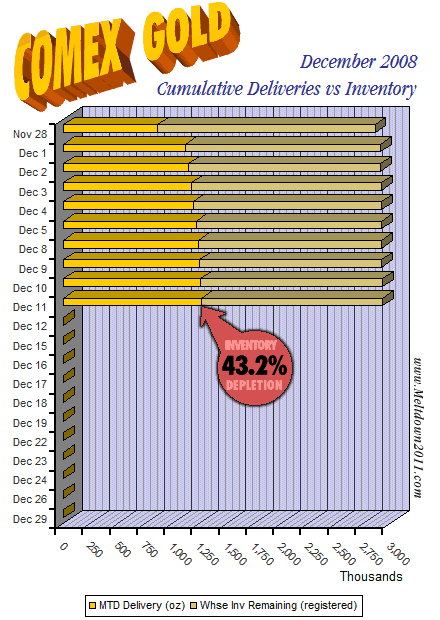

Speaking of deliveries, another 307 deliveries were assigned this morning. I can tell you that 43 of those were retenders by Greenwich Capital Markets. The total so far this month is 11,473 contracts or 1,147,300 ounces. I want to see the warehouse totals over the next couple of days before commenting on that. Time is needed to actually move the metal that is going out.

And don't forget about the COMEX countDOWN:

1 comment:

Thanks for the tip Indenture.

Post a Comment

Comments are set on moderate, so they may or may not get through.