After my last post, Think like a Giant 2, another gold writer who I consider a friend sent me an email that included a question. I had a thorough answer to his question in mind, but at the same time he said he thought it was basically unanswerable. After considering this conundrum, I concluded that the perspective reflected in the email completely missed the point and was so loaded with hard money preconceptions that the best way for me to frame my answer was by painting a whole new picture starting with a blank canvas. A big task, I know. And he may very well reject my answer, but perhaps it will be of use to someone. Anyway, here's his email followed by my reply:

FOFOA,

I enjoyed reading your post today and agree with its premise, though it raised a question in my mind: if one size buyer is able to expose the paper fraud, let’s say by steadfastly trying to take delivery of 25% of open interest on the COMEX one random settlement and then going to the press when the exchange fails to deliver, AND YET, to your point, size buyers do not have incentive to expose the fraud because it’s only a hedge – not a wealth creator – then why should we expect fiat to ever be reconciled with gold? It would seem size holdings of physical that may represent only, say, 6% of a portfolio’s wealth (e.g. Saudi), would much prefer keeping the fiat game going?

Are you implying reconciliation ultimately relies on the disaggregated global masses knowing enough to exchange their paper claims for physical?

Your post raised an issue we've struggled with. I don't know if it's a question with a definite answer. Spontaneous social reactions against power are always possible and have long precedent. My thoughts are it requires general hunger and oppression. I'm sure you'd agree that's where unreserved fiat ultimately leads. As you may know our particular view is that power will preempt that, 1) because they can and 2) because they'll get rich in the process.

XXXX

Hello XXXX,

First, and for the record, I don't expect anyone to intentionally break the system or "expose the fraud" as you say. I don't think that was ever A/FOA's message. Those who dream of blowing up the system simply aren't capable of doing it, and those who are capable wouldn't dream of actually doing it.

In your COMEX example you imagine someone trying to buy more of something than is obviously available at that time and then crying foul (or fraud) when the market can't deliver more than it has. Giants know that the best way to accumulate something at their level is slowly, over time, and within the volume offered on the market. And they also know what happens if they use their oversized weight to rock the boat:

FOA: While so many of our gold bulls salivate at the prospects of some player calling for delivery and driving the gold derivatives market to the moon; it ain't gona happen! Our world of dollar based gold derivatives has grown so large and become so integrated into supporting (hedging) international dollar assets, the central banks will band together to crush any delivery drive.

This is in the ECBs interest as I will explain in a moment.

If some big player said he was going to take 100 million ozs out of the paper gold market, the Central Bank systems would just order him to trade out for liquidation only and go to the cash market to buy his gold. Don't think I'm confusing Comex positions and their rules as being different from the rest of the world gold market. What works on comex works everywhere when the system is at risk. The controlling governments, who's domain Bullion Banks reside in, would, could and will force those holders of bank busting positions to simply cash out for the good of their system.

By the way; not only does a liquidation market send baby gold bulls running to sell, also, the BBs would be selling enough additional paper to temporally send gold down $100 bucks so our boy would trade out with a little less cash (smile). Then he would find an opposite "premium" spike in the cash markets, waiting for his order.

I hope my little dose of reality drives some sense into our gold community. This is the reason Another says only fools try to buy their gold all at once on the paper markets. "NOONE" is going to exercise their "corner" until the dollar based gold system is changed.

That said, it is an important distinction to keep in mind that aggressively attacking a system in that way and defensively withdrawing your support for an outdated system are two different things. Any Giant who has "done the math" as FOA said, and therefore understands change to be "a political certainty", would be properly positioned for change and would therefore be indifferent to the timing as opposed to trying to influence it.

I do think, however, that there have been massive efforts to influence the timing, but I think that they were efforts to support the old system rather than to quicken its demise. And this view reveals a fragile system in need of support as opposed to a resilient system impervious to attack. This is my view which I gained from A/FOA, and I'd like to take this opportunity to try and explain the big picture as I see it.

I plan to turn this into a post, so my apologies for the length and I'm not necessarily writing all of this specifically for you. But I would like to challenge you to temporarily set aside everything you think you know about the gold market while you read the following. That's not to say I'm trying to change your mind, but I'd like you to see the picture I'm painting as separate and different from the picture you already have in mind. I think it might just be that different. So rather than trying to reconcile the ideas below with what you already know, like morphing two pictures into one, I'd rather have you walk away with two distinct pictures that you can then compare and contrast to one another.

Another Big Picture View

Let's think about all of the physical gold in the world. If we include above and below ground gold, we can imagine a fixed amount, every ounce already owned by someone in extremis. Even undiscovered deposits are owned by the sovereign if push comes to shove. This is a handy view because it's like poker chips on a table. There are a fixed amount of chips and they simply get moved around the table, changing ownership, location and value from time to time. We could even think of the gold in the ground as a reserve of chips locked away in the dealer's tray.

But the thing about physical gold is that it very rarely moves. Let's switch to thinking only about all of the above-ground gold in the world. Perhaps 95% of it lies very still for very long periods of time, often spanning generations. Some may wonder how this is possible. It is possible in the same way that any piece of physical property, be it real estate or an old piece of jewelry, can stay in the possession of a wealthy family for generations, even centuries in some cases.

As long as a family (or country or any unit in aggregate) is producing more than it consumes, or at least receiving an income greater than its expenses, it can accumulate property without the need to ever sell it. Physical gold, in this case, is accumulated and held for the possibility of resale at some point in the unknown future which could be decades, generations or even centuries from now. It has always been this way, but for the last century or so it has not been this way so much in the West. As Another said, it is mostly the "third world no ones" who keep the physical market "bought up." "The Western public," he said, "will not hold an asset that is going nowhere, at least in currency terms."

So we have (very roughly) 95% of the world's physical gold lying very still, but what about the other 5%? Perhaps half of that is recycling plus new supply coming out of the mines that "moves" (i.e., changes ownership and/or changes physical location) on its way to its final (long-term) resting place, and the other half, perhaps, is us shrimps trading coins and jewelry along with a few "big" changes of ownership. Like chips on the poker table, 95% is sitting very still in the big stacks while maybe 2.5% new chips are added each year and, perhaps, another 2.5% are moved around (churned) "in play" each year.

Again, I'm only talking about physical here, and I'm only guesstimating the numbers while allowing for a large margin of error. The gold market is so opaque that it's the best I can do in order to explain the big picture.

Now as you know, we have our (in very general terms) "developed economies" in the West, and the "developing" or "emerging" economies of the East. And the status quo (net-consumption) of the West, at least for the last 40 years, relies on the net-production of the East as is clearly evident in the balance of trade and capital accounts over that period. The only problem is that "the East" still likes physical gold even as "the West" lost its taste for "dead assets". So while Eastern products (including oil) flowed west, some amount of physical gold had to flow east. Here's the second line from the first post in ANOTHER (THOUGHTS!):

It was once said that "gold and oil can never flow in the same direction". If the current price of oil doesn't change soon we will no doubt run out of gold.

I wonder if he was talking about the price of oil in dollar terms or gold terms there.

An interesting question is why the dollar reserve-based IMFS (international monetary and financial system) didn't fall apart at some point after 1971, and how it miraculously stabilized in the early 80s. In fact, the European central bankers feared that the $IMFS was on the brink of collapse by 1979, and what I've learned from A/FOA is that there were basically two things that held it together. We could call these things the "two legs of support" for the dollar system. One was organic or natural, and the other was inorganic and intentional, for a purpose and to an end.

The first leg of support, the organic one, was what FOA called "a new era of efficiency" brought on by technological advances, leaps and bounds really, throughout the 70s, 80s and 90s. As long as productivity expansion (a natural deflationary force) was keeping up with or exceeding monetary inflation, it acted as a leg of support for a dying monetary system. Here is FOA in January of 2000:

FOA: This system balanced, as the value received from oil by the goods producing world outran the loss from price inflation initially created from rising oil prices. This does not explain everything, by any means. But, it does at least give us a handle on the dollar transition throughout the 70s and 80s. Looking back one can see that "money theory" wasn't thrown out the window, only reworked a great deal.

It wasn't by pure chance that this "new era of efficiency" coincided with the end of the gold standard and thereby acted as a leg of support for continuing the dollar system. In fact, the "new era" was partially responsible for the 1971 monetary transition from a gold-backed dollar to an oil-backed (or productivity gain-backed) dollar.

FOA: The old system was built on a much slower creation of production efficiencies and couldn't accommodate this modern surge of wealth (and debt). Let's face it, the world has no precedent for the last 30 years of growth. By adhering to the fixed money supply, currencies would have risen in value creating a deflationary effect on the debt created from this growth.

But the East, and especially the Saudis, still liked their physical gold. And they still got it, even with the gold window closed. These guys in the East don't care about the currency price of gold, they just want physical gold at whatever price in exchange for their net-production to hold for the unknown future. Only the West cares about the currency price and won't hold it if the currency price is going nowhere, but will scoop it all up if the currency price takes off.

So the second leg of support for the troubled $IMFS, the inorganic and intentional one that began around 1980, was a two-pronged effort by the European central banks to give both the Americans and the East what they wanted in order to buy the time needed to launch the euro. The two prongs of the approach were 1) supporting US debt and 2) promoting and supporting changes to the gold market that would allow the physical to flow where it needed to go without a premature gold revaluation that would have blown up the current fiat system and disrupted international trade as it reverted back to a hard gold standard. And it worked, for the most part.

FOA: In practical theory, oil now backed the dollar as world oil payments were settled in dollars. In return, gold now backed oil from a US guarantee of an open market for the metal. Over time, a portion of oil dollars could be replaced with real gold through actual physical purchases or in participation with evolving world gold banking (paper gold). Even though the dollar gold price had surged, the higher oil prices were allowing a percentage of those dollars to be converted back into gold at the old gold/oil rate.

Now here's an interesting concept. If the price of gold and oil rise in tandem, then the oil producers who like their physical can still take the same volume of gold (by weight) out of circulation even though the currency price is rising. No revaluation of gold versus oil has occurred. But there are a couple of problems with that. In a gold bull market (rising price), Western traders will snatch it up in order to stick it to "those who like their physical" in currency terms. And the more physical the market is, the more this feeds back upon itself leading to an upward spiral of all prices like we saw in the 70s, something that is avoided in a revaluation.

In fact, the US Treasury could have revalued its gold in 1971 like it did in 1934 rather than closing its gold window, but it didn't. And more to the point, the other CBs (BIS) didn't lobby them to do so because they thought the system needed to change more broadly than a simple dollar devaluation in order to accommodate the "new era of efficiency".

FOA: By adhering to the fixed money supply, currencies would have risen in value creating a deflationary effect on the debt created from this growth… This is the reason the BIS did not lobby the US to officially devalue the dollar in gold (raise the dollar gold rate from $42 to say $200) and continue the system. Even though many people were hurt from this, the system was failing and had to change. The tactic was not to stop using dollars if the gold was not delivered, but rather for the US to just stop shipping the gold. In reality the dollar is still a receipt for $42 in gold, but it will never be connected to gold again. Ever!

There are a few big differences between a gold revaluation and a gold bull market (rising price). The first one that I already mentioned is that in a bull market Western traders will hoard gold in order to stick it to those in the East who really want it (stick it to them in currency terms). A revaluation, on the other hand, happens by surprise and overnight so there's no bull market for Western traders to take advantage of those who want the gold for long term reasons. Plus, if revaluation had happened in 1971, then we would have still been on the gold standard, at least throughout the 70s. So once again, the price would have gone nowhere during that time and, as Another said, "the Western public will not hold an asset that is going nowhere, at least in currency terms."

The second big difference, also already mentioned, is that the volume (by weight) required by those in the East who like their physical would have been reduced by a revaluation whereas it stayed mostly the same for the next 30-40 years with no revaluation in oil terms. The third difference is that normal correlations hold during a bull run because it is gradual which allows the time necessary for arbitrage to prevent any revaluation in real terms. The instantaneous nature of a revaluation denies arbitrageurs the time they need to react. This applies for both planned and unplanned revaluations. For an idea of what unplanned revaluations look like, check out some of the bubble collapses of the last 300 odd years.

The fourth difference relates specifically to 1971 since the choice to not revalue also meant the end of the gold standard. In a gold standard, surplus currency used to redeem gold from the gold window was taken out of circulation. But in the "free market" that resulted from closing the gold window, those same dollars continue to circulate even after being traded for gold.

So here we have a slightly different picture emerging than the one I read about most places. While the US certainly had self-serving reasons for closing the gold window (for one, a higher oil price without too much inflation made strategically valuable but more costly North and South American oil reserves more viable), the European CBs went along with it in order to get off the gold standard. "Even though many people were hurt from this, the system was failing and had to change." And a simple revaluation of the gold within the gold standard was apparently not the change they thought was needed. But the 70s were still a turbulent time, as transitions (and feedback spirals) can sometimes be.

FOA: Initially this created instability in the financial system. Throughout the 70s players ran into gold, trying to regain the monetary security the dollar had lost without it. Soon, everyone realized that no amount of conversion would ever replace all the foreign dollars outstanding—the dollars stayed in circulation even as they were traded for gold. Further, the dollars were still being received by ME oil producers in return for oil. Dollar price inflation was bad, but in no means did we see the "runaway price inflation" that should have come from a reserve currency without gold backing.

Getting back to the two-pronged approach of the second leg of support for the troubled $IMFS which began around 1980, I said that the first prong was support for US debt. In essence, the European central banks recycled all those foreign dollars that continued to circulate by soaking them up and then lending them back to the US. Much like the PBOC has done for the last decade, Europe did all throughout the 80s and 90s until they finally launched the euro in 1999. This had the effect of keeping global dollar-denominated inflation in check while allowing the Americans to keep on spending a seemingly unlimited flow of magical (inflation-resistant) dollars.

The second prong was the creation and promotion of a new type of gold market in the early 80s. To understand the goal of this new market, let's go back to my guesstimate of the stock and flow of physical gold. Remember that I am guessing that about 5% of all of the physical gold in the world moves (changes ownership and/or changes physical location) each year. In fact, that guess may even be high. Today about half of that, 2.5%, is coming from recycling and new mine production. The other half would be one owner selling and a new owner buying. So let's think about this in terms of gross aggregates that we'll call the West and the East.

In general, we should expect to see a net flow of physical gold from the West to the East, especially during times when the currency price of gold is flat (i.e., "going nowhere"). This flow could be achieved in two ways. One way is Westerner owners dishoarding and the other way is from the Western mines/recycling. But if the price of gold is rising, as it does during a bull market, then the Western traders will be hoarding rather than dishoarding, and may even be taking some of that Western mine supply. This would tend to put stress on the flow needed to keep the East happily net-producing especially without a gold revaluation in oil (real) terms.

Imagine now, if you will, that "the West" (or more specifically Western goldbugs aka Western gold traders, so as to exclude Western mines, scrap recycling, governments, CBs, and perhaps even Western old money Giants who appear to share the same long term taste for physical as "the East") is always, in aggregate, in one of three states of physical gold ownership. It is either accumulating, dishoarding, or simply churning amongst itself some amount of physical gold. Ignore paper gold, mining shares and whatever else here, I'm only talking about physical gold.

Now imagine that you are a European central banker in 1980, or at least a Giant-sized mover/shaker in consultation with them, considering and discussing this view of the East and the West, the gold market, the troubled $IMFS and the future prospects of a "euro" currency and how to buy enough time (thought to be one decade at that time but it turned out to be two) to get there. This group, of which you are a part, consists of (in my estimation) between 30 and 300 souls. You are one of them. And the fact that they confronted Volcker with fears of a dollar collapse in 1979, and that a few days later Volker took bold action, is not in doubt. Both sides confirm this confrontation, so there is no question about the level of influence this group possessed.

What would you do to secure the necessary flow of gold from the West to the East? Well, here's what they came up with:

ANOTHER: It truly started with Barrick, in Canada in the 80s. It was a "thin market", but grew big in oil.

FOA: One of the first signs that a new gold market was being created was when bullion banks were allowed to sell Central Bank gold "ownership invoices", for cash to the benefit of Barrick. The CBs got only a very small rate of return for this risk. The money set in a bank account and interest was made. The new owners of the gold paid cash but let the gold set in the CB vault. All that happened was that Barrick could earn interest on its unmined reserves and call it "the higher price they were getting for gold"! In addition, the CBs said they could roll it forward for ten years +/-, if the price of gold rose! Really clear eyes could see that the CBs were paying mines interest on unmined reserves if they would replace the CB real gold with mine collateral. Because the gold didn't really leave the vault, the new securities were used to match the mine future assets against the new owners of the gold! Neat trick. After the public bought it as "the CBs earning interest on a nonpaying asset", the gates were opened. It wasn't long before gold was lent without any gold at all! No different than "fractional reserve" banking. The mines were (are) being used to expand the gold trading arena and they don't even know what is happening. Now, as the price has fallen, all mines must earn interest on reserves, just to survive. The dollar bears are, in effect, nationalizing the mines gold reserves at ever lower prices. Tell me the CBs are dumb???

[…]

One of the reasons this trend worked so well is because the US went for it, early on. A falling gold price encouraged a strong dollar and offered Western dollar holders an avenue to hold gold in leverage form. An action they will, no doubt regret, later, as it has taken the form of stripping gold from western hands. For them, this new allocation allowed for free dollars to earn a return. Do not confuse these entities with non-western dollar reserve holders, as they (mostly) purchased straight gold future certificates (with CB backing) using resources as the leverage, not gold. Usually, this was the actual gold in the CB vaults as it was leased out, but never moved. Truly, this was the source of the same money that went into mine forward sales (barrick?). The gold and the money stayed in the CB house and control. The entire above outline is why some analysts (Ted Butler?) cannot understand why the gold doesn't physically move, yet physical demand is being supplied. This conversion process was accounted for in the LBMA volume, as it became evident after gold fell below $360US. It was then, and only then that LBMA announced these huge monthly transactions.

So here we have a genuine "central bank gold price suppression scheme" beginning in the 80s. Only the collaborators, motives, purpose, mechanism and end game are all different from the ones I normally read about from Western gold writers. It's not the Fed or the ESF/PPT meddling in the paper markets or dumping physical like the Treasury auctions in the 70s. In fact, the suppression mechanism is the popularity of the gold market itself, including the mines! The irony here, which Another pointed out, is that Western gold trader enthusiasm caused the very effect about which those same traders incessantly complained and concocted conspiracy theories to explain. Brilliant irony I must say, if one can step back and view it from afar.

The purpose of the scheme was so that the physical coming out of the Western mines could flow to those in the East who really like their physical while the Western gold trader taste for physical was held in check by a price that went nowhere for two decades. But we didn't hear those in the East complaining about the price, only the Western traders who were unwittingly complicit in their own frustration as they bought into this new gold market hand over fist.

The end game of the scheme was to make it to the launch of the euro, at which point the central bank leasing could be capped and unwound, and the costly support of US debt expansion ended. Gold would then be free to rise and/or be revalued against oil which was long overdue. It was never a sustainable scheme meant to last forever as these European CBs had to put their own gold on the line in order to support the fragile dollar system to keep it from self-destructing prematurely. Apparently, according to Another, even all of the new gold coming out of the mines each year was not enough to satisfy the East's taste for physical without an eventual revaluation.

ANOTHER: The Western governments needed to keep the price of gold down so it could flow where they needed it to flow. The key to free up gold was simple. The Western public will not hold an asset that going nowhere, at least in currency terms. […]

To avoid a spiking oil price the CBs first freed up the public's gold thru the issuance of various types of "paper future gold". As that selling dried up they did the only thing they could, become primary suppliers! […]

The BIS and other various governments that developed this trade ( notice I didn't use conspiracy as it was good business, as the world gained a lot ) , thought that the paper gold forward market would have allowed the gold industry to expand production some five times over! Don't ask where they got this, as they are the same people that bring us government finance and such. But, without a major increase in gold supply, the paper created by this "gold control operation" will either be paid by, 1. new supply. 2. the central banks. 3. rollover existing. 4. cash? 5. or total default! As the Asians started buying up everything last year ( 97 ) , number 5 and 5 started looking like the answer! When the CBs started selling into this black hole of demand, the discussion of #5 started in their rooms also. […]

People wondered how the physical gold market could be "cornered" when its currency price wasn't rising and no shortages were showing up? The CBs were becoming the primary suppliers by replacing openly held gold with CB certificates. This action has helped keep gold flowing during a time that trading would have locked up. Westerners should not be too upset with the CBs actions, they are buying you time!

Let's try accepting Another's words at face value and see where they lead. Barrick switched from oil to gold mining in 1983/84. Annual global gold mine production in 1985 was just under 50 million ounces. If technology and the new paper market could have helped expand that "five times over" it would have eventually reached 250 million ounces per year. But that didn't happen. In 1990 annual production had increased 20% to about 60 million ounces, 72 million ounces per year by 1995 and about 82 million ounces in 2000 where the growth cycle ended. A total increase of 64% rather than the 500% increase they had hoped for. But even that should be enough gold for the East, right? I mean, how much useless metal do they need?

ANOTHER: Gold is cornered. Plain and simple. No complicated theories, no options problems. The commodity value of gold was forced so low in paper currency terms that all of the new mined gold, going out some 10 years is spoken for.

Now the CBs will have to sell 1/3 to 1/2 of their gold just to cover what's out there. To use the Queen's English "it ain't gona happen dude"!

If the current price of oil doesn't change soon we will no doubt run out of gold.

That was in 1997. "All of the new mined gold, going out some 10 years is spoken for." You can do the math. So how much useless metal do those barbarians in the East really need? I mean, this sounds crazy, doesn't it? Well, apparently it got so bad around the time of the first Gulf War that they had to cut a deal with the biggest or at least most important player (threat) at that time if they wanted to make it to their goal of a clean euro launch party.

ANOTHER: Ever notice how many important middle eastern people keep a residence in London? It's not because of the climate. The most powerful banks in the world today are the ones that trade oil and gold. It is in the "city" that the deals are done by people who understand "value"! Westerners should be happy that they do because the free flow of oil and gold has allowed this economic expansion to continue this past few years. […]

What quantity of GOLD, paper or physical, has OIL traditionally purchased on an annual basis? From 1991, appx. 20m/oz./yr., now it is more.

This was the gold for oil deal in 1991, 20 million ounces per year. For that to be a deal, it must have been a decrease from what otherwise would have been sought. Why would "we" get a deal? Perhaps someone explained the plan/scheme (or "gold control operation") as I have done so far. You blow it up now, what do you get? A lot less in real terms. But if you play ball, you still get a good percentage of the annual mine supply. And 20 million ounces per year would have been about a third of annual global (not just Western) mining supply in 1991, all going to just one single player in the barbaric East where, for some reason, they like their useless metal.

But by 1997, the cost of maintaining this deal had apparently tripled!

ANOTHER: For the monthly amount to be taken off the market has changed from $10 in gold ( valued at $1,000 ) /per barrel to the current $30 in gold /per barrel still valued at $1,000! Much of this gold was in the form of deals in London to launder its movement. Because of some Asians, these deals are no longer being rolled over as paper!

Oh no, you mean it's not just the Arabs that like useless metal in the East? We've got to worry about the Asians too?

ANOTHER: Asia put an end to a sweet deal for the West! From the early 90s it was working very well.

[…]

The Asians are the problem, by buying up bullion worldwide and thru South Africa they created a default situation on all the paper for the oil / gold trade! Now the CBs are selling in the open to calm nerves but it's known that they will never sell enough. It was never their intent to provide the gold, only the backing until new mining technology could increase production. Over time the forward sales, such as ABX's should have worked. But LBMA went nuts with the game and the whole mess has now accelerated. […]

The oil "understanding" was broken by the Asians. More gold has been sold than can ever be covered!

Damn. First the Arabs, now the Asians… who's next? And what the heck do these Eastern barbarians do with all of that useless metal anyway??? What if they do nothing with it other than stick it in a vault somewhere where it will sit as long as they keep net-producing until some unknown time in the future when they are forced to net-consume? If that's the case, then maybe the actual weight-volume they receive in exchange for their surplus currency doesn't matter. In fact, the greater the weight, the larger the vaults they need to build or rent. I wonder if they would be just as happy receiving a lower weight-volume of revalued gold. Here's an appropriate quote from my 2010 post It's the Flow, Stupid:

[T]he price of gold does not matter to the [East], only the flow of gold matters. I'll say it again. The [East] doesn't care about the price of gold, only the flow. To the [East] the price doesn't matter because it is a straight currency exchange, like exchanging dollars for euros.

Did you see it in the article? Aramco owed the Saudis $3 million a year, but it had to be paid in gold. They didn't owe 2.67 tonnes of gold per year, but that's what they had to pay because the US fixed the price of gold at $35 per ounce. The US could have raised the price of gold to $100/ounce and then it would have only had to ship .93 tonnes of gold to the Saudis! Would the Saudis have been displeased with such a move? No. The guaranteed price of gold only matters to the printer of paper gold. To the producer/savers, all that matters is the guaranteed flow of physical!

Let's now jump forward to 1999 and look at three important events that happened that year. The first and most important one happened on January 1st when the European central banks successfully launched their new euro currency. Then, in May, Gordon Brown pledged to sell half (~400 tonnes) of England's physical gold over the next three years. Some say this was a move meant to suppress the price of gold. Others say it was simply a mistake of bad timing. But perhaps it was neither. Perhaps it was necessary to feed the flow a little while longer. Then, in September, the European central banks collectively and publicly announced their intention "not to expand their gold leasings and their use of gold futures and options" for the next five years at which time the agreement would be reviewed.

Bull Run versus Revaluation

I want to discuss the significant differences between a bull run and a revaluation because we got one and not the other after the euro was finally launched and European CB support was removed. As I already mentioned, in general, revaluations are usually quick and surprising while bull runs are gradual which allows more and more people to get onboard at different points in the run. With a revaluation, you're either onboard or not when it happens.

Another big difference is that the singular nature of a revaluation (one single item revalued/devalued) means that the item is revalued in real terms vis-à-vis everything else while a bull run is often merely a rise in nominal terms because other related (or correlated) items, more or less, usually go along for the ride. We could say that the whole group of correlated items (e.g., commodities) is revalued in real terms vis-à-vis another group (e.g., S&P500) during a run, but I hope that you can see the difference between the "gold bull market" of the last decade and a gold revaluation in real terms that is long overdue. It is the latter that Another and FOA explained.

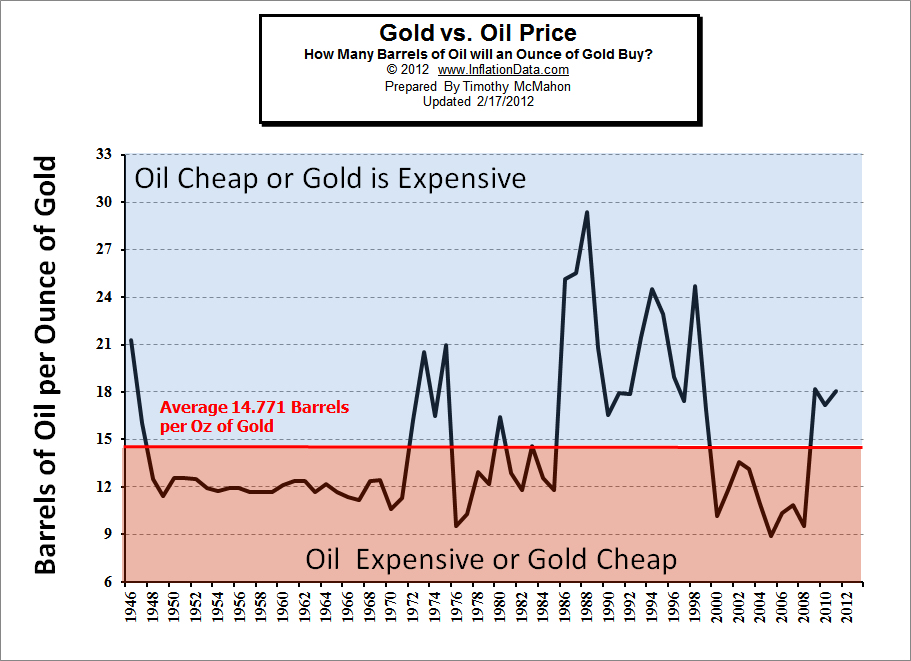

Even though we've seen orders of magnitude swings in the nominal price of gold, from $35 up to $850, back down to $250 and then up to $1,900, the price of gold in oil terms (the "gold/oil rate" that FOA mentioned above) is the same today as it was in 1947, 1974 and 1999 at the launch of the euro. In other words, there has been no revaluation… yet. So when we think about the incredible bull market run we've had in gold since 2001, I think it is also important to keep in mind how little has actually changed in real terms. Here is the GOR (gold oil ratio) data going back to 1946, from inflationdata.com:

| Annual Average Gold and Crude Price 1946-Present | # of bbl Oil 1 OZ Gold will buy | ||

|---|---|---|---|

| Year | Average $/bbl | Average $/oz | Ave bbl / oz |

| 1946 | $1.63 | $34.71 | 21.294 |

| 1947 | $2.16 | $34.71 | 16.069 |

| 1948 | $2.77 | $34.71 | 12.531 |

| 1949 | $2.77 | $31.69 | 11.440 |

| 1950 | $2.77 | $34.72 | 12.534 |

| 1951 | $2.77 | $34.72 | 12.534 |

| 1952 | $2.77 | $34.60 | 12.491 |

| 1953 | $2.92 | $34.84 | 11.932 |

| 1954 | $2.99 | $35.04 | 11.719 |

| 1955 | $2.93 | $35.03 | 11.956 |

| 1956 | $2.94 | $34.99 | 11.901 |

| 1957 | $3.00 | $34.95 | 11.650 |

| 1958 | $3.01 | $35.10 | 11.661 |

| 1959 | $3.00 | $35.10 | 11.700 |

| 1960 | $2.91 | $35.27 | 12.120 |

| 1961 | $2.85 | $35.25 | 12.368 |

| 1962 | $2.85 | $35.23 | 12.361 |

| 1963 | $3.00 | $35.09 | 11.697 |

| 1964 | $2.88 | $35.10 | 12.188 |

| 1965 | $3.01 | $35.12 | 11.668 |

| 1966 | $3.10 | $35.13 | 11.332 |

| 1967 | $3.12 | $34.95 | 11.202 |

| 1968 | $3.18 | $39.31 | 12.362 |

| 1969 | $3.32 | $41.28 | 12.434 |

| 1970 | $3.39 | $36.02 | 10.625 |

| 1971 | $3.60 | $40.62 | 11.283 |

| 1972 | $3.60 | $58.42 | 16.228 |

| 1973 | $4.75 | $97.39 | 20.503 |

| 1974 | $9.35 | $154.00 | 16.471 |

| 1975 | $7.67 | $160.86 | 20.973 |

| 1976 | $13.10 | $124.74 | 9.522 |

| 1977 | $14.40 | $147.84 | 10.267 |

| 1978 | $14.95 | $193.40 | 12.936 |

| 1979 | $25.10 | $306.00 | 12.191 |

| 1980 | $37.42 | $615.00 | 16.435 |

| 1981 | $35.75 | $460.00 | 12.867 |

| 1982 | $31.83 | $376.00 | 11.813 |

| 1983 | $29.08 | $424.00 | 14.580 |

| 1984 | $28.75 | $361.00 | 12.557 |

| 1985 | $26.92 | $317.00 | 11.776 |

| 1986 | $14.64 | $368.00 | 25.137 |

| 1987 | $17.50 | $447.00 | 25.543 |

| 1988 | $14.87 | $437.00 | 29.388 |

| 1989 | $18.33 | $381.00 | 20.786 |

| 1990 | $23.19 | $383.51 | 16.538 |

| 1991 | $20.19 | $362.11 | 17.935 |

| 1992 | $19.25 | $343.82 | 17.861 |

| 1993 | $16.74 | $359.77 | 21.492 |

| 1994 | $15.66 | $384.00 | 24.521 |

| 1995 | $16.75 | $383.79 | 22.913 |

| 1996 | $20.46 | $387.81 | 18.955 |

| 1997 | $18.97 | $331.02 | 17.450 |

| 1998 | $11.91 | $294.24 | 24.705 |

| 1999 | $16.55 | $278.98 | 16.857 |

| 2000 | $27.40 | $279.11 | 10.186 |

| 2001 | $23.00 | $271.04 | 11.784 |

| 2002 | $22.81 | $309.73 | 13.579 |

| 2003 | $27.69 | $363.38 | 13.123 |

| 2004 | $37.41 | $409.72 | 10.952 |

| 2005 | $50.04 | $444.74 | 8.888 |

| 2006 | $58.30 | $603.46 | 10.351 |

| 2007 | $64.20 | $695.39 | 10.832 |

| 2008 | $91.48 | $871.96 | 9.532 |

| 2009 | $53.48 | $972.35 | 18.180 |

| 2010 | $71.21 | $1,224.53 | 17.196 |

| 2011 | $87.04 | $1,571.52 | 18.055 |

| Average | 14.771 | ||

Another big difference between a bull run and a revaluation is the absolute impossibility of the paper market or the structure of contractual obligations and liabilities going along for the ride. Think about the 1934 gold revaluation. The dollar at that time was the paper proxy for physical gold, and the revaluation was vis-à-vis that paper proxy. Today, the paper gold market is analogous to the dollar in 1934.

A bull run certainly puts stress on the paper edifice, but because it is gradual and drawn out and because other items that may have been used to hedge exposure generally remain correlated during a run, the various counterparties do have the advantage of time to make adjustments. Here is FOA in 1999 when gold was $280 an ounce talking about Barrick trying to get out of its paper commitments if gold rose past $600 (oh, the foresight!):

FOA: As the physical price rises well past the paper price, every miner and user in the world will be trying to get out of their commitments. Even Barrick now admits (finally) that above $600 they have to start supplying margin. After all this time of telling everyone that they could defer their contracts for 10 or 15 years. This goes back to my post about "Westerners" not thinking that gold will rise. Because investors thought it was impossible for it to go above $600, to consider that long term gold lenders would not ask for margin was nuts. If gold hit $5,000 does a lender just depend on ABX's good word?? It shows the beautiful evolution of "Western investment thought". Again, LBMA will not be in a position to advise anyone as this plays out. Truly, this relic of London's past will be put on a shelf.

Here's a short article from AEP in 2009 that I'll post in full as it is relevant to this discussion in several ways:

Barrick shuts hedge book as world gold supply runs out

By Ambrose Evans-Pritchard

11 Nov 2009

Global gold production is in terminal decline despite record prices and Herculean efforts by mining companies to discover fresh sources of ore in remote spots, according to the world's top producer Barrick Gold.

Aaron Regent, president of the Canadian gold giant, said that global output has been falling by roughly 1m ounces a year since the start of the decade. Total mine supply has dropped by 10pc as ore quality erodes, implying that the roaring bull market of the last eight years may have further to run.

"There is a strong case to be made that we are already at 'peak gold'," he told The Daily Telegraph at the RBC's annual gold conference in London.

"Production peaked around 2000 and it has been in decline ever since, and we forecast that decline to continue. It is increasingly difficult to find ore," he said.

Ore grades have fallen from around 12 grams per tonne in 1950 to nearer 3 grams in the US, Canada, and Australia. South Africa's output has halved since peaking in 1970.

The supply crunch has helped push gold to an all-time high, reaching $1,118 an ounce at one stage yesterday. The key driver over recent days has been the move by India's central bank to soak up half of the gold being sold by the International Monetary Fund. It is the latest sign that the rising powers of Asia and the commodity bloc are growing wary of Western paper money and debt.

Now think back to the view I presented of the period from, say, 1985 through 1999 regarding the flow of physical from West to East. During this period we had a number of factors which combined to "supply the demand". We had a price that "went nowhere" along with a new paper market that encouraged Westerners to give up their physical gold in exchange for leveraged trading paper. When that ran out, we had the European CBs becoming the "primary suppliers". We had a deal in place with one of the larger "Eastern barbarians". We had a gradual increase in mining supply from 50 million ounces up to 82 million ounces per year, and we also had the mines selling their "future assets" up to ten years out backed by CB gold. And finally, we had almost 400 tonnes of physical from Her Majesty's Treasury "given to the cause" at the tail end of this period. All of these factors are gone today.

What we have instead today is a stagnant mining supply, a declining scrap supply, CBs adding to their gold in aggregate, Westerner traders hoarding physical in places like GLD and PHYS and a price that rose more than "five times over". You'd think that would "stretch" the available supply relative to demand some five times over, but you'd be wrong. Only a revaluation in real terms can "stretch" the flow sufficiently and sustainably.

Just like FOA said about the 70s, "the higher oil prices were allowing a percentage of those dollars to be converted back into gold at the old gold/oil rate." The old gold/oil rate has fluctuated narrowly but hasn't changed in 67 years. Another said, "Gold has always been funny in that way. So many people worldwide think of it as money, it tends to dry up as the price rises." One more piece of data to support this point. The LBMA publishes its clearing volume monthly. If we go back to the beginning of the bull run, around mid-2001 when the price of gold was in the $260s, and compare it with the clearing volume today, we see that demand in currency terms rose right along with the price. So much for "stretching".

Also, I am still operating under the assumption that the East didn't lose its taste for gold just because the currency price started rising. And in case you thought "oil" was a bigger player than "the Asians", that's not the picture Another painted:

ANOTHER: This whole game was not lost on some very large buyers WHO WANTED GOLD BUT DIDN'T WANT IT'S MOVEMENT TO BE SEEN! Why not move a little closer to the action by offering cash directly to the broker/bank ( to be lent out ) in return for a future gold note that was indirectly backed by the CBs. That "paper gold" was just like gold in the bank. The CBs liked it because no one had to move gold and it took BIG buying power off the market that would have gunned the price! It also worked well as a vehicle to cycle oil wealth for gold as a complete paper deal.

Are you with me?

Well a funny thing happened right after the Gulf war ended. What looked like big money before turned out to be little money as some HK people, I'll call them "Big Trader" for short, moved in and started buying all the notes and physical the market offered. The rub was that they only bought low, and lower and cheaper. They never ran the price and they never ran out of money. Seeing this, some people ( middle east ) started to exchange their existing paper gold for the real stuff. From that time, early 1997 LBMA was running full speed just to stay in one spot! In other words paper volume had to increase to the physical volume on a worldwide scale, and that was going to be one hell of a jump. It could not be hidden from the news any longer.

That was the 90s. I don't think "the game" is the same today. In fact, I think that "the game" needed to change in 1997, and that may be why Another took his story public in the only way he could. Ari once told me that he thought Another's reason for going public with this story was to telegraph a message to certain people. I won't expand this thought any further because I would only be speculating, but I will tell you that my speculation makes perfect sense to me. And check this out, from FOA in 2000 when one of the regulars on the forum questioned the credibility of what he was saying. I'll post Cavan Man's message in full because I think it reflects a lot of the skepticism we see today right here on this blog, and then FOA's reply. Notice the highlighted sentence:

Cavan Man: Dear FOA,

I am not certain how many visitors here carefully read and digest what you write. Furthermore, I am even less sure how many of us really believe what you write. With my simple mind, I see the common cents of it all. Perhaps my mind is simple because I have not the formal education nor experience level of many, consequently my simple mind is also very open to new Thoughts; it is not so encumbered with preconceived notions. I'm a long ways back but still following you on the trail

I have read your posts from this morning which filled in some blanks for me generated by my reading and re-reading of Aristotle's five part series of last summer. I have just taken the time to read Aristotle once more. Each reading provides keener insight. Each reading gives me a greater sense of concern for future events as you seem to project them.

Here is my question:

Can the international monetary system transition to a new form; can ME oil be satisfied; can the international currency value of gold be reconciled with even the modest expectations of traditional (western)thinking gold market analysts; can individual, sovereign economies remain "whole" and healthy; can the paper gold market leverage be unwound; etc. without the advent of violence and aggression? How so?

Perhaps I should stop reading USAGOLD and go back to the comic section of our local and very poor newpaper?

Thank you.....Cavan Man

FOA: Cavan Man, Yes, I think you are right. There really is no point in going back so far. Nor is there any gain in diving so deep to explain political strategy just ahead. Mostly we want to understand the short term. Another warned me about this once before. Saying I should stay on the surface and discuss events as they apply. Looking back I see why he doesn't send me anything now. The point has been made and the correct people have seen it. Now wait for events and discuss the market response. So be it. I'll ride the soft river and stay off the hard trail. Thanks Cavan Man, your words have helped, I presume too much, FOA

As you can imagine, the forum begged FOA not to stop "diving so deep." You can read the responses to FOA's comment here. But the point is that something changed. "The game" today is not the same as it was in the 90s. To be honest, without the guidance of an "insider" like Another and his confidant FOA "discussing events as they apply" "to explain political strategy just ahead," I struggle to understand how the gold market has gone on without a revaluation in real terms as long as it has. But I do have a theory that I think fits what we've seen so far.

Incidentally, my theory comes from a 2010 email exchange with the only person I know of who had direct email contact with FOA, and who I believe gleaned more insight from Another and FOA than anyone else, Aristotle. But don't judge it on that; judge it on how it fits into the big picture painted above.

I will repeat what I said at the top. I don't expect anyone to intentionally break the system. I don't think that anyone with a big enough footprint capable of breaking the system would ever dream of actually doing it and then living with the stigma that would come from such an act. Instead, I think that the system is fragile, in need of support, and without that support it will crumble on its own. It is not just "their" system. It is your system, my system, everyone's system. It is a global system, and yet it is an old, fragile and failing system. But as FOA said, "everyone that is positioned in physical gold will carry this storm in fantastic shape."

Why did he write "physical gold" and not just gold? Because he wasn't just talking about a bull run, he was talking about the inevitable revaluation that'll come when the old and fragile system crumbles under its own weight. But today there's a new system already in place, functioning under the old system, but built to withstand the failure of the old gold market. Nothing need rise from the ashes. It is already here. And it is "anti-fragile" meaning that it will not only withstand the shock, but be improved by it.

This is checkmate. And it is not a gold standard. But even so, to use your words at the top of the post, we can "expect fiat to be reconciled with gold." Not just once, but on an ongoing basis. Here is the rest of what FOA said:

FOA: This not only has "everything to do with a gold bull market", it has everything to do with a changing world financial architecture. And I have to admit: if you hated our last one, you will no doubt hate this new one, too. However, everyone that is positioned in physical gold will carry this storm in fantastic shape. This is because the ECB has no intentions of backing their currency with gold and every intention of using gold as a "free trading" financial reserve. None of the other metals will play a part in this.

Now let's look at what we know has happened since Another and FOA stopped writing. First, the "Brown's Bottom" UK gold auctions ended in early 2002. From that point, the rest of the European CBs sold some 1,650 tonnes, which ended in early 2009:

The time period of the sales in that chart includes the addition of four new Eurosystem members, along with their gold, so the total sold by the European CBs is actually higher than 1,650 tonnes. And whether these sales went to fulfill past obligations or to satisfy new customers is an interesting question, but I doubt if it really matters much because we know the general direction of the necessary flow.

I suppose it is somehow possible that the output from Western mines and scrap recycling, topped off by a few Western central bank sales, supplied GLD, PHYS and other toys of Western traders while also satisfying the insatiable demand for useless metal from our Eastern barbarian trading partners on whom we rely for their continued and selfless net-production, these last 14 or so years. Meanwhile, we more physically inclined Western shrimps traded (churned) our coins while our Western CBs punched one tonne at a time into new discs giving us the illusion that it's business as usual.

If not, then perhaps the above was supplemented by the discreet (and discrete) "pairing up" of buyers and sellers of a more, shall we say, Giant size, those whose footprint would have left a distinct mark, perhaps even a trail of destruction, if it had landed in our gold marketplace. If this was the case, as was (at the very least) implied by Another, then it would have included some sort of a promise of inevitable revaluation, backed not only by logic, but also by history, a long-term plan of action, and some measure of past success. In other words, the checkmate scenario.

In any case, we now know that the European CB gold sales have ended, Western mine/scrap supply is in decline, and the USG is still spending like there's no tomorrow, even as it has to print up new dollars! ;D And, thankfully for the West, the songbirds are singing the end of the bull run, gagging GLD into puking up a hairball or two for the cause. All is well in Oz, right?

Checkmate

The game of chess ends before it is over. It ends when a player can legally declare checkmate because the losing player is destined to lose on the next move. But good players know when a game becomes "hopeless" much earlier, and so these "expert" games often end before checkmate can even be legally declared. They end when checkmate is inevitable, when the losing player acknowledges defeat.

In practice, most strong players resign an inevitably lost game before being checkmated, and it is considered bad etiquette to continue playing in a completely hopeless position. But there is some small hope for those players who haplessly continue playing rather than resigning. The hope lies in the remote possibility of a mistake by the other player.

Weak players, on the other hand, seldom resign. At a competent level it is considered discourteous to play on in a clearly lost position. But while it is bad etiquette to refuse to resign in a completely hopeless position, if you are ignorant as to whether your position is hopeless you should play on.

The dollar game was lost on 1/1/99 and we're just playing out the remaining moves right now. I think this is the correct perspective, even if it doesn't give us any actionable timing information other than "yesterday was the best time to buy physical gold, today is the second best and tomorrow is a distant third."

The gist of my theory (for those who haven't been following my blog closely) is that at some point support for the old edifice will be withdrawn, and then it will crumble under its own weight. But it is so big and heavy that, when it finally gives way, it will come down faster than you can react. There will be no warning. The only warning you can hope for is to look for signs that support has been withdrawn. And I should add that those whose only net-production is of the paper variety (e.g., the US, UK and Japan) cannot offer structural support to this failing edifice.

So that's basically the big picture as I see it for the last 40 years or so. But before I wrap this up, I want to briefly recap this view within the larger context of a 100-year time frame in order to add a little more perspective and grounding.

The Big, Big Picture in a Nutshell

If we look back to the monetary conference in Genoa (1922), I'd say that conference really set the finite timeline of the dollar in motion, much more so than the creation of the Federal Reserve System in 1913. The creation of the Fed simply put the US on equal footing with the rest of the world in terms of the ability to have a flexible monetary base, which helped make the international move in Genoa possible. From Peak Exorbitant Privilege:

And so even though the U.S. wasn't directly involved in the European monetary negotiations that took place in Brussels in 1920 and Genoa in 1922, it was acknowledged that any new monetary order was likely to be a U.S. centered system. […]

The Roaring Twenties was not just a short-lived period of superficial prosperity in America, it was also a time when a great privilege was unwittingly granted to the United States that would last for the next 90 years. And I say "unwittingly granted" because the U.S. did not even participate in the negotiations that led to its privilege. As Jacques Rueff wrote in his 1972 book, The Monetary Sin of the West:

"The situation I am going to analyze was neither brought about nor specifically wanted by the United States. It was the outcome of an unbelievable collective mistake which, when people become aware of it, will be viewed by history as an object of astonishment and scandal."

The next thing I look at is the evolution of thought that transpired after 1922, mainly through Jacques Rueff who wrote a Freegold-sounding piece decades earlier than anyone else. It's chapter 2 in The Age of Inflation and, while it's not perfect Freegold, it sounds a lot more "Freegoldish" to me than his contemporaries in the more formal economic schools of the time. And by "Freegoldish" I mean realistic and practical with a focus on the balance of trade and how the flow of gold is an integral part of its monetary adjustment mechanism as opposed to some sort of theoretical economic idealism.

I always thought that Freegold (free market gold) thought originated with French thinkers like Jacques Rueff and then took hold with a wider European contingent throughout the 70s as part of "the road to the euro". After all, it was the French that ran on the gold window in the 60s, and then they were the first to mark their official gold reserves to the market price in the mid-70s.

Following the evolution of thought beyond France, from 1969 I have a speech by Alexandre Lamfalussy, a European central banker from Hungary, that fits quite well. And then in the 70s we can add Jelle Zijlstra, a Dutch central banker who really gets it early on. So we can see signs of an evolution of thought that spread throughout the European CB community in, perhaps, the late 60s and 70s. The ECB itself marks the beginning of "the road to the euro" in 1962.

That doesn't mean that everyone involved in creating the euro understood Freegold, particularly those who had spent more time in America, like Robert Mundell and Robert Triffin. But you've got to understand how big of a project this was, creating a new international currency in just a few decades. A lot of people were involved in the effort in many different capacities, and not everyone would have been privy to the discussions that resulted in the CBs leasing their gold to buy time for others involved to complete their part.

In terms of the dollar's finite timeline, I think we can view the point at which the US had about 20,000 tonnes of gold as the top of the hill. That was 1950 through 1957, the period directly following Bretton Woods, a monetary conference in which the US not only participated, but ran the show. From 1957 to 1961, the US gold stockpile lost more than 25%, dropping from 20,000 tonnes down to 15,000. Having peaked, it would be natural for those who could see the end far off in the distance to start thinking about what would come next. And as if a kind of natural selection or survival of the fittest ideas took place, perhaps Rueff's ideas took hold in the early 60s among some who could actually make a move.

We do know that Rueff was one of de Gaulle's economic advisors during the 60s. So I think it is fair to imagine the "Nixon shock" as a move forced by the French. It forced the creation of a "free market" for gold by the same entity that had been running (controlling) the previous fixed market. Perhaps getting the gold wasn't the French goal as much as it was to force the creation of a new "free gold marketplace" in which CBs could openly (rather than covertly as in the London gold pool) participate.

What better way to force a permanent bank holiday on the old system than for a giant (like France) to run on its own bank (the US Treasury) while holding a press conference about it? Incredibly, France demanded its gold from the US while it was still covertly involved in the London gold pool. And then France was the first to back out of the gold pool. And then France was the first to mark its gold to the market price in 1974. From Once Upon a Time:

From 1965 through late 1967 the gold pool was expending more and more of its own gold just to keep the price in its range. Seeing this, France (who was one of the insiders and knew of the price fixing operation) began demanding more and more gold from the US Treasury for its dollars.

And as this trend progressed, the world was flooded with more and more dollars that were backed by less and less gold, creating an extremely volatile situation. Public demand for gold was rising, the war was escalating, the pound was devalued, France backed out of the gold pool, and in one day, Friday March 8, 1968, 100 tonnes of gold were sold in London, twenty times the normal 5 tonne day.

The following Sunday the US Fed chairman announced that the US would defend the $35 per ounce gold price "down to the last ingot"! Immediately, the US airlifted several planeloads of its gold to London to meet demand. On Wednesday of that week London sold 175 tonnes of gold. Then on Thursday, public demand reached 225 tonnes! That night they declared Friday a "bank holiday" and closed the gold market for two weeks, "upon the request of the United States". (So much for "the last ingot", eh?)

That was the end of the London Gold Pool. The public price of gold quickly rose to $44 an ounce and a new "two tiered" gold price was unveiled; one price for central banks, and a different price for the rest of us. Even today official US gold is still marked to only $42.22 per ounce, $2 LESS than the market price in 1968!"

I think it's fair to say that today's particular game of chess began around 1962, and by 1968 the French, following Jacques Rueff's advice (who was probably already writing The Monetary Sin of the West which he would publish four years later), put the dollar in check. Not checkmate, mind you, but just check which forced Nixon to make his "shocking" move in 1971 (a move that would have been fully predictable by any competent player).

Then, in early 1979, the European central bankers created the ECU (European currency unit-currency code XEU) which was to be eventually replaced with the euro. But by late 1979, they feared the current system was on the verge of collapse which, they thought, would send the world right back onto a hard gold standard. So, what to do? I guess you'd quickly figure out a way to support the failing system long enough to complete your mission. And guess what, it worked!

So I think we can view 1971 as an important inflection point in the finite timeline of the dollar that began in 1922. How long could the Bretton Woods gold standard have continued if the French hadn't demanded their gold and backed out of the London gold pool? We'll never know, because that wasn't how this game was played. And then, I think we can say that the dollar's gameplay has been on life support ever since 1980 when it would have otherwise ended. Kind of like when an expert poker player lets a "fish" win once in a while just to keep his money in the big game.

The real question is, at what point did checkmate become inevitable. At what point could an expert player have called the game over? That point was the launch of the euro. As FOA said, everyone was betting 10 to 1 against the euro right up until launch day! Even Another was apparently worried that the gold market was going to blow up and ruin it just a year or two too early. I think that's why he started contributing to the Kitco forum. Can you imagine the tension in the room? You're on the final stretch of a 37 year project, with less than two years to go, and something as stupid as the Eastern barbarian's love for physical gold is threatening the completion of your project. This puts the whole ANOTHER (THOUGHTS!) in a bit of a different light, does it not?

Perhaps the initial message Another wanted to telegraph was this: "ALL PAPER WILL BURN" and "the CBs will never cover all of the paper gold that's out there. To use the Queen's English, ain't gonna happen dude."

Remember, he said that the Asians broke the deal and were the big new threat, and he said that they "never ran out of money", yet they were buying up all of this CB-backed paper that was being offered by the BBs run amok. So was the intended recipient of the message the Asians, or just Giants in general (who tend to have lots of paper kindling of all kinds), or was it the BBs? Whoever it was, FOA said they got the message and, as we now know, they made it to launch day so it must have worked.

So why not push for checkmate once the game is already won? Well, just because you expect and want something doesn't mean you want all of the negative side effects that go along with it. If the dollar had collapsed in 1999 then the euro would have forever carried that stigma, which might have been less than preferable to its parents. Furthermore, it was a brand new currency system in its infancy. Exactly how much confidence did they have in its resilience, its "anti-fragility", especially if the US currency collapsed immediately in its wake?

They had the base money, inflation and the MTM gold under control, but some elements of the 1993 Maastricht treaty, namely government finance through the private banking system, were still flapping in the wind. This is something that the ECB would have known earlier than the rest of us. Yet as of 2013, that part is mostly secured.

On top of that, we had 9/11 in 2001 and the GFC in 2008. I can accept that Europe decided to support the US for a period after 9/11. That fits and it is about the time that the European CB gold sales began, ending in 2009. This goes against the theory that those sales were simply booking the physical loss of previously leased gold. But I never liked that theory much because it goes against what Another and FOA wrote about the leases, and the mines should have been able to fulfill those obligations since more than 10 years have now passed.

Then again, if the mining supply of the last decade went mostly to those who purchased it in the 90s, what physical supplied the East (in addition to GLD/PHYS) over the last decade? And therein lies a mystery that can only be solved, as far as I can figure, by some sort of discreet (and discrete) deal-making that would have included a promise of inevitable revaluation. Also, Ari told me that from at least 2005, according to his readings of the CB journal, it seemed that 2010 was being targeted to be the new transition window:

"For the past half-decade, many international policy stirrings gave every indication to me that 2010 was to be the targeted year for assertively rolling forth the freegold paradigm. But as I've said previously, I feel that the ongoing financial crisis that began with the subprime fiasco has caused instability of such magnitude that the central bankers have been forced to delay briefly and "play it safe" -- one does not dare rock the boat (if there remains any choice in deciding the matter) when the financial waters have become so turbulent and choppy. As for the new timeframe, I'd say that the reported EU plan "to make private bond holders shoulder some of the pain from any sovereign debt restructuring after mid-2013" is as good an indication of a benchmark as any I've seen."

I imagine that the "official support" from 2009 onward could have been more derivative oriented than physical because I imagine they realized in Oct./Nov. of 2008 that the greatest threat now is a falling price for paper gold. The East doesn't care if the price falls, in fact that's when they like to back up the truck because they get more bang (tonnes) for their buck when that happens.

I think that the "gold" market today is largely driven by the currency trade (XAUEUR, XAUUSD, etc…) which dwarfs the physical side. It's so big that the BBs can control the price of gold by controlling the extent to which they hedge on COMEX/GLD/etc. versus how much they hedge in correlated derivatives. That is, they can easily control the price whenever there is too much demand, but not so much if the demand for their paper evaporates. They'd be buying their own paper and going short in the physical market or correlated markets, a suicidal exercise.

So official support could have been as simple as the CBs entering the FOREX markets and buying up XAUWHATEVER when needed. This makes sense because in the 2009 CBGA they excluded the line about leasing, futures and options. This could have opened the door for them to engage in the derivatives market.

Note also that John Paulson was rumored to have sold a large XAUEUR position (paper gold hedge that allowed him to denominate his fund in gold ounces) back in December. That was reported as him simply selling "gold", and it was cited as one of the reasons for the decline in price which led to my Dec. 26th post and question about whether "someone" would step in just before Snapshot day. Soros was also rumored to have sold half of his "gold" around the same time.

The point is that no one stepped in. The BBs would have then had to remove their long hedges which would take the price down. And that's roughly how I think the much larger paper market runs the "gold" price these days, through the selective hedging activities of the BBs. But there's nothing they can do if the price falls too fast like it did in 2008. They can't buy their own paper and the Eastern demand for physical (by weight) explodes when that happens.

Lastly, I will leave you with a puzzle. I predict that, upon revaluation, global gold mining supply will undergo a sudden and dramatic contraction. But why would that be? If the value and price of gold is suddenly so much higher, wouldn't the mines run at full steam? I don't think so, and there's the puzzle.

So there you have it. The game is already won, has been since 1/1/99, but checkmate has not yet been declared so it continues. And that's why I named 2013 the year of the window. What do you think so far? Have you seen any signs yet that this is not the year of the window? I haven't. And no, I'm not expecting the "disaggregated global masses" to suddenly wake up and exchange their paper claims for physical. Nor am I expecting some kind of "spontaneous social reaction against power" that will "expose the paper fraud" and bring down the house, forcing the reconciliation between fiat and gold. I do, however, expect reconciliation, just not in one of the ways described in the email at the top of this post. ;D

Oh, and I expect it soon.

Sincerely,

FOFOA

PS. If you appreciate and enjoy what I do with this blog, then please read Defending the Precious and support my efforts here. I won't be selling any of my barbarous relics at the worst time to sell in all of human history. So it's either your support or I take another offer. And I do have another offer, but I'd prefer to keep doing this. ;D