Rather than attempt the impossible task of following all these ramifications in each of the myriad of social visions, the discussion here will group these visions into two broad categories—the constrained vision and the unconstrained vision. These will be abstractions of convenience, recognizing that there are degrees in both visions, that a continuum has been dichotomized, that in the real world there are often elements of each inconsistently grafted on to the other, and innumerable combinations and permutations. With all these caveats, it is now possible to turn to an outline of the two visions, and specifics on the nature of man, the nature of knowledge, and the nature of social processes, as seen in constrained and unconstrained visions. […]

The two great revolutions in the eighteenth century—in France and in America—can be viewed as applications of these differing visions, though with all the reservations necessary whenever the flesh and blood of complex historical events are compared to skeletal theoretical models. The underlying premises of the French Revolution more clearly reflected the unconstrained vision of man which prevailed among its leaders. The intellectual foundations of the American Revolution were more mixed, including men like Thomas Paine and Thomas Jefferson, whose thinking was similar in many ways to that in France, but also including as a dominant influence on the Constitution, the classic constrained vision of man expressed in The Federalist Papers. […]

With all the complex differences among social thinkers as of a given time, and still more so over time, it is nevertheless possible to recognize certain key assumptions about human nature and about social causation which permit some to be grouped together as belonging to the constrained vision and others as belonging to the unconstrained vision. Although these groupings do not encompass all social theorists, they cover many important figures and enduring ideological conflicts of the past two centuries. […]

William Godwin's elaboration of this unconstrained vision in his Enquiry Concerning Political Justice drew upon and systematized such ideas found among numerous eighteenth-century thinkers—Jean-Jacques Rousseau, Voltaire, Condorcet, Thomas Paine, and D'Holbach being notable examples. This general approach was carried forth in the nineteenth century, in their very different ways, by Saint-Simon, Robert Owen, and by George Bernard Shaw and other Fabians. Its twentieth-century echoes are found in political theorists such as Harold Laski, in economists like Thorstein Veblen and John Kenneth Galbraith, and in the law with a whole school of advocates of judicial activism, epitomized by Ronald Dworkin in theory and Earl Warren in practice. […]

This constrained view of human capacities found in Adam Smith is also found in a long series of other social thinkers, ranging from Thomas Hobbes in the seventeenth century, through Edmund Burke and the authors of The Federalist Papers among Smith's contemporaries, through such twentieth-century figures as Oliver Wendell Holmes in law, Milton Friedman in economics, and Friedrich A. Hayek in general social theory.

Not all social thinkers fit this schematic dichotomy. John Stuart Mill and Karl Marx, for example, do not fit, for very different reasons, as will be noted in Chapter 5. Others take midway positions between the two visions, or convert from one to the other. However, the conflict of visions is no less real because everyone has not chosen sides or irrevocably committed themselves.

Despite necessary caveats, it remains an important and remarkable phenomenon that how human nature is conceived at the outset is highly correlated with the whole conception of knowledge, morality, power, time, rationality, war, freedom, and law which defines a social vision. These correlations will be explored in the chapters that follow.

Because various beliefs, theories, and systems of social thought are spread across a continuum (perhaps even a multi-dimensional continuum), it might in one sense be more appropriate to refer to less constrained visions and more constrained visions instead of the dichotomy used here. However, the dichotomy is not only more convenient but also captures an important distinction. Virtually no one believes that man is 100 percent unconstrained and virtually no one believes that man is 100 percent constrained. What puts a given thinker in the tradition of one vision rather than the other is not simply whether he refers more to man's constraints or to his untapped potential but whether, or to what extent, constraints are built into the very structure and operation of a particular theory. Those whose theories incorporate these constraints as a central feature have a constrained vision; those whose theories do not make these constraints an integral or central part of the analysis have an unconstrained vision. Every vision, by definition, leaves something out—indeed, leaves most things out. The dichotomy between constrained and unconstrained visions is based on whether or not inherent limitations of man are among the key elements included in the vision.

The dichotomy is justified in yet another sense. These different ways of conceiving man and the world lead not merely to different conclusions but to sharply divergent, often diametrically opposed, conclusions on issues ranging from justice to war. There are not merely differences of visions but conflicts of visions.

- THOMAS SOWELL, A CONFLICT OF VISIONS: Ideological Origins of Political Struggles

The Debtors and the Savers are also abstractions of convenience, a dichotomized continuum justified by the not merely different, but sharply divergent, often diametrically opposed, conclusions on a wide range of issues that divide the two camps, which leads to conflict, and ultimately ends in either tears, bloodshed, or both:

In the first Debtors and Savers back in 2010, I agreed with Karl Marx’s statement that “the history of society is the history of class struggle,” but I disagreed with his delineation of the classes as the workers versus the capitalists, the rich versus the poor, or the haves versus the have-nots. My delineation was “the easy money camp” or “the redistributors,” which I dubbed the Debtors for short, versus “the hard money camp” or “the live within their means and take personal responsibility for their own future camp,” which I dubbed the Savers for short.

Marx and I merely have two different perspectives on history. But Marx’s perspective is wrong yet almost universally held, dangerous because it often leads to bloodshed, and politically expedient to the Left because it rousts envy in the have-nots. Meanwhile, my perspective, being the correct yet little known one, actually reveals how Freegold is the elegant solution to one of the oldest conflicts in the world. Instead of trying to force hard money on the easy money camp to keep their savings from devaluing, the Savers will simply stop saving in money, debt and financial instruments.

They will stop, because they will get burned in a way that will live in the collective memory forever, or at least for generations. Easy money systems, as I discussed in the post, have a typical profile of gradually transferring purchasing power from the Savers who save in money, debt and financial instruments, to the Debtors. Then, at the very end of the system, they have one final, very rapid wealth transfer, from paper’s remaining purchasing power into real things, primarily real wealth items that can be possessed, because physical possession is wealth’s defining attribute, especially at such times as the end of an easy money regime.

This change won’t deprive the Debtors of money to borrow, because if there’s one thing we know about easy money, it’s that you can easily make more of it. What it will do, however, is to keep the Saver’s savings from being disproportionately drained of value by an expandable monetary system. This will solve, once and for all, one of the oldest conflicts in the world, that of the Debtors and the Savers trying to use the same monetary unit, whether easy or hard, for both borrowing and saving, which has always ended in either bloodshed or tears for the Savers.

Hard money systems tend to end in violence, uprisings, bloodshed and even war, as I discussed in the post, while easy money systems tend to end in monetary collapse and financial devastation for unprepared Savers. Today we are at the end of the longest-running easy money system ever, so “Choose your camp wisely,” as I said in the post, “and prepare to own the future.”

[…]

Freegold is kind of like the middle ground, or center, between the two camps. It is the compromise, the obvious solution, but that doesn’t mean that I’m a centrist when it comes to politics. I can see that, as Ari said, we need our money to be “easy” in order to set gold free to be the “hard” wealth reserve par excellence that is needed to keep the peace. We get our “hard” secondary money, let them have their “easy” primary money, and learn to appreciate the elegance of the arrangement!

In fact, since most of us intuitively hail from the hard money camp, it’s a healthy exercise to embrace the idea of money being even “easier” in Freegold than it is today. Easy money saps value from every monetary unit on record, so today that disproportionately taxes the savers through the financial system, but in Freegold it won’t. So I don’t expect money to be any “harder” in Freegold. Since it will have a smaller pool of value to sap from, it may even be “easier” than today’s money.

As FOA said, we have always formed “tribes” or groups, in which we trade some measure of our personal freedom of choice for the security of being part of a larger group. Within that group, subgroups tend to jockey for control in order to bend the rules in their favor, in order to regain some of what they perceive they have lost by being part of the group, at the expense of other subgroups. It’s just the way we are as a species, and understanding human nature and how to work within it, rather than forever struggling to change it, is really what Freegold is all about.

As for the two most general subgroups, most would agree they are the political Left and Right. But from a monetary, economic and financial perspective, we always see the divide framed as the rich versus the poor. Yet there are rich and poor on both sides of the political spectrum, or ants and grasshoppers in each of our nations as Yanis said, so obviously we need a better framework of understanding if we are to comprehend what is actually unfolding.

That framework is the Debtors and the Savers, as I have defined them in terms of easy versus hard money preference, and in terms of social versus personal responsibility being primary. This understanding also blends extremely well with the history of the political Left and Right, revealing an undeniable connection between political and monetary evolution and change.

With this view, we can see how the rise of Progressivism to absurd levels has paralleled the rise of the dollar-based international monetary and financial system to its own absurd levels. It’s easy to see what constitutes Progressivism, but if you are willing to buy the idea that both have peaked, then it’s important to also understand what constitutes the $IMFS. Because while Conservatism stands ready to take control back from Progressivism, there’s no way in hell that we’re going back to hard money.

What most fundamentally constitutes the $IMFS is simply the idea that money, debt and financial instruments constitute wealth. As Randy said in Debtors v. Savers III, “Instead, your wealth, properly measured, is the tangibles you’ve accumulated, the store of resources you’ve saved. And among the world of tangibles, gold is globally the most liquid — the most universally recognized, honored, and accepted.” This is what will change monetarily: the simple idea of what constitutes wealth.

If you are still struggling with this concept, just think about what it actually is that makes the $IMFS seem so absurd today, not just in the US, but all around the world. It is the perception of wealth held in money, debt and financial instruments that is so disproportionate to the real economy. And not just the size, but the rate and direction of change. The perception of wealth can expand in the $IMFS even while the real economy is shrinking. This is why Another always said, “Your wealth is not what your money say it is.”

So, basically, Freegold is not about us versus them, it’s about living together without monetary conflict. And because of pride, envy and the lot of them, monetary conflict is indeed at the heart of these political conflicts. So while it might be a bit much to say Freegold will solve every problem, I think it’s fair to say it will at least reverse the incentives and send us “progressing” in a better direction.

-The Debtors and the Savers 2016

Over in Europe, the migrant crisis is the front line of "Progress" versus push-back. Of course Europe doesn't have the same idea of free speech as we do in America, so we don't get to hear as much from the conservative resistance as we do from the Progressives, who label anyone opposed to massive immigration from the Arab world, North Africa and the Middle East, as xenophobic, racist or worse. In some places, you can be arrested for simply saying the wrong thing about the crisis, or even just tweeting it.

We do get a glimpse, though, at what is developing over there. In Sweden, anti-immigration groups are labeled as Nazis, yet we continue to hear stories about these "no-go" zones which are essentially Muslim slums where even the police don't go. Such stories are considered racist and routinely suppressed inside Sweden, but just a few weeks ago, an Australian 60 Minutes crew was attacked in one of these areas, and published the video saying there are now 55 such no-go zones in Sweden. So apparently there are reasons other than being a Nazi to hold an anti-immigration stance in Sweden.

In Germany, just days ago, hundreds of "left-wing protestors" clashed with thousands of members of the Alternative für Deutschland (AfD) party who were meeting in Stuttgart. The protestors chanted "Keep refugees, drive Nazis away!" But I looked into this group, and they appear to not be as "far-right" as some. They are actively trying not to attract more radical ultra-nationalists, they are fearful of being labeled "xenophobic or even racist," and have shied away from supporting similar groups as a result. They have, however, labeled Merkel's decision to accept a million migrants in 2015 as "catastrophic," they would like to ban the burqa and outlaw minarets (the towers from which Muslims announce obligatory prayer time five times a day) in Germany, and they are also opposed to gay marriage. Freakin' "Nazis" (yeah, right). Fascism, for example, heavily emphasizes surrogate decision-making but is not an unconstrained vision, because neither the mode of decision-making nor the mode of choosing the leader is articulated rationality. It is not merely that non-fascists find fascism non-rational, but that fascism's own creed justifies decisive emotional ties (nationalism, race) and the use of violence as political driving forces. It is only when both the locus of discretion and the mode of discretion consistently reflect the underlying assumptions of either the constrained vision or the unconstrained vision that a given social philosophy can be unambiguously placed under either rubric. […]

I wrote that post eight years ago, to the day. Trump had just, days before, become the presumptive nominee. Bernie Sanders was leading Hillary on the other side, but just barely. Seth Rich, a Bernie supporter, was still alive. The DNC emails had not yet been leaked to Julian Assange. Nelle Ohr, aka KM4UDZ, would get her Ham radio license exactly two weeks later, on May 23, 2016, so that she could coordinate the fabrication of a Russian kompromat file on Trump with Christopher Steele in England. And over in England, the Brexit vote was still a month and a half away.

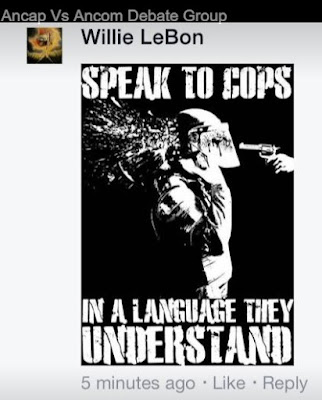

Here is one of the images from that post:

I wrote:

In chapter 5, Sowell explains how both Fascism and Marxism are hybrid visions. If you've ever noticed the irony in Antifa ("anti-fascists") actually being a bunch of fascists, or that Nazis (National Socialists) were actually socialists, or how the left is in league with actual Nazis in Ukraine, and has been since 2014, then this chapter is for you! Here are a few select excerpts:

A given vision may fall anywhere on the continuum between the constrained and unconstrained visions. It may also combine elements of the two visions in ways which are either consistent or inconsistent. Marxism and utilitarianism are classic examples of hybrid visions, though in very different ways.

Marxism

The Marxian theory of history is essentially a constrained vision, with the constraints lessening over the centuries, ending in the unconstrained world of communism. However, at any given time prior to the advent of ultimate communism, people cannot escape—materially or morally—from the inherent constraints of their own era. It is the growth of new possibilities, created by knowledge, science, and technology which lessens these constraints and thus sets the stage for a clash between those oriented toward the new options for the future and those dedicated to the existing society. This was how Marx saw the epochal transitions of history—from feudalism to capitalism, for example—and how he foresaw a similar transformation from capitalism to communism.

This hybrid vision put Marxism at odds with the rest of the socialist tradition, whose unconstrained vision condemned capitalism by timeless moral standards, not as a once progressive system which had created new social opportunities that now rendered it obsolete.

Marx spoke of "the greatness and temporary necessity for the bourgeois regime," a notion foreign to socialists with the unconstrained vision, for whom capitalism was simply immoral. As in more conservative compromises with evil, Marx's temporary moral acceptance of past capitalism was based on the premise that nothing better was possible—for a certain span of past history, under the inherent constraints of those times. His efforts to overthrow capitalism in his own time were based on the premise that new options now made capitalism both unnecessary and counterproductive.

But just as Marx differed from other socialists because he believed in inherent constraints, he also differed from those like Smith and Burke who conceived of these constraints as being fixed by human nature. To Marx, the constraints were ultimately those of material production and the frontiers of those constraints would be pushed back by the march of science and technology. Eventually, the preconditions would exist for the realization of goals long part of the socialist tradition, including the production and distribution of output "from each according to his ability, to each according to his needs." But no such principle could be simply decreed, without regard to the stage of economic development and the human attitudes conditioned by it.

According to Marx, it was only "after the productive forces have also increased with the all-around development of the individual, and all the springs of co-operative wealth flow more abundantly—only then can the narrow horizon of bourgeois right be crossed in its entirety and society inscribe on its banner: 'from each according to his ability, to each according to his needs!"' Marx's vision was therefore of a world constrained for centuries, though progressively less so, and eventually becoming unconstrained. Engels called this "the ascent of man from the kingdom of necessity to the kingdom of freedom."

Marxian doctrine, as it applies respectively to the past and the future, reflects the reasoning respectively of the constrained and the unconstrained visions. Looking back at history, Marxism sees causation as the constrained vision sees it, as systemic rather than intentional. In Engels' words, "what each individual wills is obstructed by everyone else, and what emerges is something that no one willed." When referring to the capitalist and pre-capitalist past, individual intention was as sweepingly rejected as a source of social causation in Marxism as in Adam Smith or any other exemplar of the constrained vision. Unlike many others on the political left, Marx did not regard the capitalist economy as directly controlled by the individual intentions of capitalists, but rather as controlling them systemically—forcing them to cut prices, for example, as technology lowered production costs, or even forcing them to sell below cost during economic crises. Similarly, bourgeois democratic governments were seen as unable to control insurgent political tendencies threatening their rule.

Marxian moral as well as causal conclusions about the past were consistently cast in terms of a constrained vision. For ancient economic and social systems, slavery and incest were considered by Marx to be historically justified, because of the narrower inherent constraints of those primitive times. Nor would the immediate post-revolutionary regime envisioned by Marx sufficiently escape constraints to decide deliberately when to end the state; rather, systemic conditions would determine when and how the state would eventually "wither away."

Only in some indefinite future was the unconstrained world, which Marxism sought, expected to be realized. In speaking of that world, and contrasting its desirable features with those of capitalism, Marx's language became that of the unconstrained vision. "Real" freedom of the individual, to be realized under Marxian communism, meant "the positive power to assert his true individuality," not merely the "bourgeois" freedom of the constrained vision—"the negative power to avoid this or that."

According to Marx and Engels:

Only in community with others has each individual the means of cultivating his gifts in all directions; only in the community, therefore, is personal freedom possible.

Looking backward, Marx and Engels saw the emergence of bourgeois freedom—political emancipation from deliberately imposed restrictions—as "a great step forward," though not "the final form of human emancipation." However, such freedom was "the final form within the prevailing order of things" that is, within the constrained world before communism, as conceived by Marx. Under capitalism, Marx considered the worker to be only "nominally free"; he was "compelled by social conditions" to work for the exploiting capitalist. Real freedom was the freedom of the unconstrained vision to be realized in a future unconstrained world. This freedom was defined as a result, in the manner of the unconstrained vision, not as a process in the manner of the constrained vision.

Marx was not inconsistent in using the concepts of the constrained vision for his analysis of the past and the concepts of the unconstrained vision for criticizing the present in comparison with the future he envisioned. His overall theory of history was precisely that constraints lessened over time, with the advancement of science and technology, and that social changes followed in their wake. As a system of contemporary political advocacy, it is an unconstrained vision—a theory that the ills of our time are due to a wrong set of institutions, and that surrogate decision-makers, making collective choices with specifically articulated rationality, are the proper locus and mode of discretion for the future. […]

The entire spectrum of social visions cannot be neatly dichotomized into the constrained and the unconstrained, though it is remarkable how many leading visions of the past two centuries fit into these two categories. Moreover, this dichotomy extends across moral, economic, legal, and other fields. This is highlighted by the fact that those economists, for example, who hold the constrained vision in their own field tend also to take a constrained vision of law and politics, while those with the unconstrained vision of law, for example, tend to favor economic and political policies which are also consistent with the unconstrained vision. This will become more apparent in the chapters that follow. Contemporary examples of this consistency across fields are no longer as numerous, simply because social thinkers who operate across disciplinary lines are not as numerous. The increasing specialization of modern times makes the kind of sweeping visions of the eighteenth century less common today. Contemporary visions are more likely to be confined to a particular field—"judicial activism" in law or laissez-faire in economics, for example—though there have been a small and dwindling number of twentieth-century thinkers, such as Gunnar Myrdal or Friedrich Hayek, whose writings on a wide range of issues have gone well beyond a single intellectual discipline. However, what makes a vision a vision is not its scope but its coherence—the consistency between its underlying premises and its specific conclusions, whether those conclusions cover a narrow or a broad range.

Nevertheless, despite the scope and consistency of both constrained and unconstrained visions, there are some other very important social visions—Marxism and utilitarianism, for example—which do not fit into either category completely. In addition, one of the hybrid visions which has had a spectacular rise and fall in the twentieth century is fascism. Here some of the key elements of the constrained vision—obedience to authority, loyalty to one's people, willingness to fight—were strongly invoked, but always under the overriding imperative to follow an unconstrained leader, under no obligation to respect laws, traditions, institutions, or even common decency. The systemic processes at the core of the constrained vision were negated by a totalitarianism directed against every independent social process, from religion to political or economic freedom. Fascism appropriated some of the symbolic aspects of the constrained vision, without the systemic processes which gave them meaning. It was an unconstrained vision of governance which attributed to its leaders a scope of knowledge and dedication to the common good wholly incompatible with the constrained vision whose symbols it invoked.

Adherents of both the constrained and the unconstrained visions each see fascism as the logical extension of the adversary's vision. To those on the political left, fascism is "the far right." Conversely, to Hayek, Hitler's "national socialism" (Nazism) was indeed socialist in concept and execution.

Inconsistent and hybrid visions make it impossible to equate constrained and unconstrained visions simply with the political left and right. Marxism epitomizes the political left, but not the unconstrained vision which is dominant among the non-Marxist left. Groups such as the libertarians also defy easy categorization, either on a left-right continuum or in terms of the constrained and unconstrained visions. While contemporary libertarians are identified with the tradition exemplified by F. A. Hayek and going back to Adam Smith, they are in another sense closer to William Godwin's atomistic vision of society and of decision-making dominated by rationalistic individual conscience than to the more organic conceptions of society found in Smith and Hayek. Godwin's views on war (see Chapter 7) also put him much closer to the pacifist tendency in libertarianism than to Smith or Hayek. These conflicting elements in libertarianism are very revealing as to the difference made by small shifts of assumptions.

Godwin's profound sense of a moral obligation to take care of one's fellow man never led him to conclude that the government was the instrumentality for discharging this obligation. He therefore had no desire to destroy private property or to have the government manage the economy or redistribute income. In supporting private property and a free market, Godwin was at one with Smith, with Hayek, and with modem libertarianism. But in his sense of a pervasive moral responsibility to one's fellow man, he was clearly at the opposite pole from those libertarians who follow Ayn Rand, for example. It was the power of reason which made it unnecessary for government to take on the task of redistribution, in Godwin's vision, for individuals were capable, eventually, of voluntarily sharing on their own. But were reason considered just a little less potent, or selfishness just a little more recalcitrant, the arguments and vision of Godwin could be used to support socialism or other radically redistributionist political philosophies. Historically, the general kind of vision found in Godwin has been common on the political left, among those skeptical of the free market and advocating more government intervention.

Logically, one can be a thorough libertarian, in the sense of rejecting government control, and yet believe that private decision-making should, as a matter of morality, be directed toward altruistic purposes. It is equally consistent to see this atomistic freedom as the means to pursue purely personal well-being. In these senses, both William Godwin and Ayn Rand could be included among the contributors to libertarianism.

The unconstrained vision is clearly at home on the political left, as among G. B. Shaw and the other Fabians, for example, or in Edward Bellamy's Looking Backward or in the contemporary writings of John Kenneth Galbraith in economics or of Ronald Dworkin and Laurence Tribe on the law. But the constrained vision, while opposed to such philosophies, is also incompatible with the atomism of thoroughgoing libertarians. In the constrained vision, the individual is allowed great freedom precisely in order to serve social ends—which may be no part of the individual's purposes. Property rights, for example, are justified within the constrained vision not by any morally superior claims of the individual over society, but precisely by claims for the efficiency or expediency of making social decisions through the systemic incentives of market processes rather than by central planning. Smith had no difficulty with the right of society to regulate individual behavior for the common good, as in fire regulations, for example, and Oliver Wendell Holmes declared that "the public welfare may call upon the best citizens for their lives."

Neither the left-right dichotomy nor the dichotomy between constrained and unconstrained visions turns on the relative importance of the individual's benefit and the common good. All make the common good paramount, though they differ completely as to how it is to be achieved. In short, it is not a moral "value premise" which divides them but their different empirical assumptions as to human nature and social cause and effect.

Another complication in making these dichotomies of social philosophy is that many twentieth-century institutions or legal precedents represent thinking that is "liberal" (in American terms) or social-democratic (in European terms), so that conservatives who oppose these institutions or precedents are often confronted with the argument that such things are "here to stay"— essentially a conservative principle. Those on the political right may thus end up arguing, on the ground of the political left, that certain policies are "irrational," while the left defends them as part of the accepted social fabric, the traditional position of the right. While these might be simply tactical debating positions in some cases, there is a very real philosophic difficulty as well. At the extreme, the long-standing institutions of the Soviet Union were part of the social fabric of that society, and communists who opposed reforming them were sometimes considered to be "conservative." Among fervent American supporters of the free-market principle, libertarians are often at odds with conservatives on welfare state institutions, including labor unions, which are now part of the American social fabric—an argument which carries little or no weight in libertarian thinking, though some conservatives find it important.

While it is useful to realize that such complications exist, it is also necessary to understand that a very fundamental conflict between two visions has persisted as a dominant ideological phenomenon for centuries, and shows no signs of disappearing. The inevitable compromises of practical day-to-day politics are more in the nature of truces than of peace treaties. Like other truces, they break down from time to time in various parts of the world amid bitter recriminations or even bloodshed.

The general patterns of social visions sketched in these chapters in Part I provide a framework for looking more deeply into the application of constrained and unconstrained visions to highly controversial issues involving equality, power, and justice in the chapters that follow in Part II. Finally, the role of visions will be assessed against related but very different concepts, such as "value premises" and paradigms.

So, isn't it interesting that the most dangerous visions of the last two centuries, Marxism and Fascism, which killed millions of people, were hybrids?

In both cases, they were ultimately unconstrained visions, but they appropriated, or used, some aspects of the constrained vision. Perhaps that gave them cover, or disguise. In any case, both were gravely divisive, by rallying those of unconstrained vision against the rest, which led to a communist takeover in the Soviet Union and China, and the rise of the Nazis in Germany, and to war and mass murder.

It was also that they were incorrect delineations of the two sides who, throughout history, are always at odds with one another. Marx essentially delineated the past from the future, implying that human nature itself can change, or progress, from the constrained to an unconstrained vision. And for the leftists that call the right fascist, or Nazis, again, the delineation is wrong because it does not hold up over time. Fascism used extreme versions of aspects of the constrained vision, like nationalism, obedience and loyalty, to transition or progress from a constrained vision past to an unconstrained totalitarian government.

We are there again today, but with a twist.

Note that Sowell first published A Conflict of Visions in 1987, and the most-recent revision was published in 2007. Harvard Psychology Professor Steven Pinker, in his 2002 book The Blank Slate: The Modern Denial of Human Nature, calls Sowell's delineation the best theory given to date. That's just to point out that this dichotomy, or delineation, has been around for a while, and I find it consistent with the Debtors and the Savers.

The Debtors, the easy money camp, have the unconstrained vision. MMT, for example, is an unconstrained view of money. Hard money is a constrained view of money. The Savers, the hard money camp, have the constrained vision of human nature and the world.

According to Sowell, those with an unconstrained vision "distrust decentralized processes, believe there is an ideal solution to every problem, and that compromise is never acceptable. He refers to them as 'the self anointed.' They believe that there exist some people who are further along the path of moral development, have overcome self-interest and are immune to the influence of power and therefore can act as surrogate decision-makers for the rest of society." They are the central planners.

The constrained vision, on the other hand, "relies heavily on the belief that human nature is essentially unchanging and that man is naturally inherently self-interested, regardless of the best intentions. Those with a constrained vision prefer the systematic processes of the rule of law and experience of tradition. Compromise is essential because there are no ideal solutions, only trade-offs. Those with a constrained vision favor empirical evidence and time-tested structures and processes over intervention and personal experience. Ultimately, the constrained vision demands checks and balances and refuses to accept that all people could put aside their innate self-interest." (Wikipedia)

Freegold is a compromise.

Sowell writes: "The inevitable compromises of practical day-to-day politics are more in the nature of truces than of peace treaties."

Freegold is a peace treaty.

Money stays easy, and everyone uses money. So everyone contributes to government theft equally.

Gold stays hard, and only Savers use gold. It's a closed circuit, as retiring savers sell their gold to young savers.

The Freegold revaluation is something totally separate. It's a one-time thing. It's only going to happen once. You aren't going to get rich by simply holding gold within Freegold, but those who carry physical gold from this system to the next will "own the future," as I wrote back in 2010.

Today we are on the cusp of something really big. Everything in the past 4 to 8 years has been leading up to this moment. To help you visualize what I see coming, it's like we're on a train that is moving very fast. Up ahead, a dump truck loaded with boulders is parked on the tracks.

Four years ago, there was semi on the tracks. It turned out to be empty, and the train smashed right through it and kept on going. This next obstacle is different, though. For years now, I thought that the train would stop, or the truck would move, or the train would derail because it is going too fast, or run out of diesel. But none of that happened. The train just keeps speeding up, because those running the train, those in charge, have an unconstrained vision of the world.

That's the twist. In Russia, China, Germany, and even in the French Revolution, the unconstrained rose up and took power from the constrained, mostly by killing them. Today, the unconstrained already have all the power. That's the twist. The American Revolution was the opposite. Today is more like the latter than the former.

This is only half of the post. You can read the other half and the 389 comments under it at the Freegold Speakeasy. It was posted there on May 8. You can join the Speakeasy by subscribing in the side bar, or you can email me at fofoamail at gmail dot com.

And don't forget to buy gold from BullionStar using my affiliate link! 😘

👇

https://www.bullionstar.com/?r=1025

Sincerely,

FOFOA