With 500 comments on the last one, a new month, a new season and a new Snapshot day upon us, I thought it was time for a fresh thread.

A few people have asked me about Snapshot day. Was it yesterday, at €984, or today, at €953? I should say that I don't put much stock in the middle quarters because they often show volatility that is not present when you only look at the major quarters. That said, Snapshot day is, in fact, this Friday, Oct. 4th. And MTM Party day is next Wednesday, Oct. 9th.

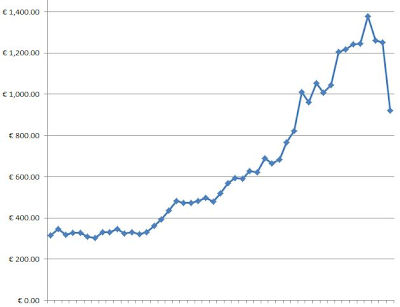

I'll show you what I mean about volatility when including every quarter. The first chart is only the annual snapshots since 2004, except for the last one on the chart which was mid-year at June 28, 2013. Aside from 2013 so far, it is a nice smooth trendline:

This second one is all of the mid-year and year-end snapshots only:

And this third chart includes every single quarterly snapshot since the end of 2001. Notice how bumpy it can be on shorter time frames:

Here's the data for all of the quarterly snapshots since Q4 2001:

2001 Q4 € 314.99

2002 Q1 € 347.32

2002 Q2 € 319.85

2002 Q3 € 326.98

2002 Q4 € 326.83

2003 Q1 € 307.80

2003 Q2 € 302.05

2003 Q3 € 329.99

2003 Q4 € 330.36

2004 Q1 € 346.04

2004 Q2 € 323.94

2004 Q3 € 332.30

2004 Q4 € 321.56

2005 Q1 € 329.76

2005 Q2 € 361.23

2005 Q3 € 393.12

2005 Q4 € 434.86

2006 Q1 € 482.49

2006 Q2 € 472.27

2006 Q3 € 474.00

2006 Q4 € 482.69

2007 Q1 € 498.20

2007 Q2 € 480.19

2007 Q3 € 520.31

2007 Q4 € 568.24

2008 Q1 € 592.75

2008 Q2 € 591.70

2008 Q3 € 627.14

2008 Q4 € 621.54

2009 Q1 € 690.19

2009 Q2 € 665.77

2009 Q3 € 683.77

2009 Q4 € 766.35

2010 Q1 € 823.13

2010 Q2 € 1,010.92

2010 Q3 € 960.58

2010 Q4 € 1,055.42

2011 Q1 € 1,007.25

2011 Q2 € 1,043.38

2011 Q3 € 1,206.40

2011 Q4 € 1,216.86

2012 Q1 € 1,243.45

2012 Q2 € 1,246.62

2012 Q3 € 1,377.42

2012 Q4 € 1,261.18

2013 Q1 € 1,251.46

2013 Q2 € 919.92

As I write this, euro gold is at €951.66. Yesterday it was as high as €989. In fact, there was a €30 swing between the AM and PM fixes today. That's some volatility!

So what's your guess? What do you think will be this quarter's snapshot to be revealed on Oct. 9? Will it be over or under €919.92? Obviously the odds favor over, but as it stands right now we are only €31.74 away from the June low, and it dropped by that much today alone! Anyone brave enough to guess under?

This is, of course, just for fun, because I don't assign much significance to a 3rd quarter snapshot either way. But I am curious to see your guesses! :D

Sincerely,

FOFOA

And since Depeche Mode is currently touring the U.S., here's an appropriate tune that I enjoy:

It's Just a Question of Time!

221 comments:

1 – 200 of 221 Newer› Newest»It seems to me like the support for snapshots was pulled a while back. With no official support for paper gold I predict a further drop to €925 by snapshot day and €850 by mid month.

Reuters: London bullion body could charge more or disband gold rates

Any thoughts on GOFO getting disbanded? IF it happens, how does one determine whether gold is in backwardation?

Snapshot €930, but more importantly, Sunday is 6/10. I predicted a couple of weeks ago (or two months?) that GLD would be closed on that day, and that we would know about it monday morning, London time. 7/10 is incidentally the 5th birthday of my second son, so we will have lots of cause for celebration in my family next week.. :-)

Edit. The prediction was made in an email to my cousin, not here...

I hope that if falls below €919.92, but without my my magic 8 ball, I can't be certain.

Happy birthday, Motley Fool.

Anand,

But Saudi Arabia wants gold for the oil.

Any proof for this—today?

@ein anderer:

Proof

:-)

@Bjorn,

You are just one year off the mark!

Yes, they are rich, and they buy gold, as the Indians and, moreover, the Chinese alike.

But are they paid in gold?

BTW China: 24hGold published yesterday a nice and comprehensive (?) overview over China's long trail of Gold …

Link to China …

Ein anderer,

Well, they sell oil and buy gold. It's just a matter of semantics. :-)

That was not the Freegold theory, I think ;)

Did not Another say that they sell oil and are paid in US-Dollars and physical gold? FOFOA’s newspaper clips gave a lot of evidence that it is highly supposable that this was the case in these days. But what about today? Is there still an agreement like this? »We export our oil. You pay with your worthless Dollar. And since we have no interest (not yet) in the fall of the USD you have to pay via physical gold too.«

Yes, yes, you are splitting hairs. ;-)

Think about it, is it less probable that they are getting paid partially in physical today, than say 20-30 years ago?

Put it another way: Is US$, backbone of the $IMFS, in better condition today, than it was 20-30 years ago?

Two quotes from the China article mentioned above:

»Just this week the PBOC announced that individuals could import seven ounces of gold tax free and without reporting to customs.«

»China is taking over the world one gold bar at a time as this new world superpower reacts to years of being on the receiving end of the US dollar and Fed money printing.«

No, it is not less probable that they are getting paid partially in physical today, than 20-30 years ago. But: It is more probable that after 20-30 years some more people know this fact than in Another’s time. Where are the wisthleblowsers which are everywhere, in every other field of secret? 20-30 years ago some people knew and 1-2 people blowed the whistle. Today many more people would know and therefore many more whistleblowers should be heard ;)

Because it’s quite a sensation, isn’t it, if the big streams of crude oil are paid with physical gold, right? Journalist would be the first to find out more.

In order to be a whistleblower you have to read all of this blog including the GoldTrail and Anothers writings. With understanding, mind you.

With all due respect to Journalists and Politicians out there, how many of them are capable of doing just that? And, to blow the whistle? :-)

BTW, wasn't Edwardo on TV couple of months ago? ;-)

FOFOA:

To calculate the coming snapshot I generally just call my guy at the IRS, he has all these charts in a massive matrix. But the phone just rings and rings. Hmmmm.

As for buying gold with dollars ... if the dollar price of gold is kept low enough it gives dollars their soon to be number one most endearing feature: the abiulity to buy gold cheaply with ;0)

As for oil. That may get a little "dicey pricey" for the dollar.

Thanks Dp.

If you are an oil state you have every incentive to keep your gold holdings and accumulation secret. That's how you maintain a low profile are prevent yourself from becoming a target for military invasion. It also makes it easier to steal the gold when foreign governments demand regime change and threaten to bomb you. Given that the Saud damily is very unpopular even in Saudi Arabia, I speculate that they would put the highest priority on covering their tracks and making the structure of the deals (and the location of any gold) all but impossible to figure out.

Dante,

to be understood correctly:

I am asking for the whistleblowers in those institutions which are directly involved into the "oil for gold" business (if it is still done like that). There must have been hundreds of insiders who have gained knowledge about this, in the last 20 years. Or am I wrong in this regard?

We and FOFOA and Edwardo, we are no insiders. We are outsiders, guessing and we are calculating what could be going on, with the help of some symptoms and signs.

Guessing and calculation could be good and enough for saving decisions. For me it is. But it is not knowledge. I am curious! :)

Makes sense, Robert—but only if this business can really be runned like this. I am imagening the oil business as something very much non-private and non-secret. But, may be, it’s not …

For me, among the real services to Humanity rendered by our host is clarification of (i) the difference between saving and investing, and (ii) what, exactly, constitutes "wealth." Regular readers of this blog know that the determinative key feature of wealth is that it be actually personally possessed. This automatically distinguishes it from all the digital, database contractual rights to payment/ownership that are summarized in the form of a monthly or quarterly statement delivered to one's doorstep.

In this vein, there are two informative articles over at The Automatic Earth on the idea of "investing as saving" that is currently en vogue throughout the land. .

No.1, "How to Maximize Your Investment Losses":

"[T]oday here's a little gem based on a comment at The Automatic Earth by regular commenter Viscount St. Albans which I liked for its educational entertainment value, an innocent piece of "for amusement purposes only", for those who are not yet poor and still think investing is a good idea. As in "Feel Lucky, Punk?"

Viscount, take it away:

Let's invest, and let's keep it simple. Basic. We'll count the links in our glass chain connecting us with our money.

Us

Link #1: The Investment Manager

Link #2: The Broker-Dealer

Link #3: The Clearing Firm

Link #4: The Exchange

Link #5: The Custodial Bank

Our Money

What could go wrong? Shall we count the ways?"

Examples then follow.

No. 2, "Your Pension Is Under Attack From All Sides"

http://www.theautomaticearth.com/Finance/your-pension-is-under-attack-from-all-sides-heres-10.html

Ein anderer,

I understand what you mean. If I were insider, I would think like this:

- Am I ready to spend couple of months at some obscure room at a random russian airport?

- For what purpose? So that a J6P can go out and buy an ounce of gold?

- J6P (EU version also) is allready broke and up to the eyeballs in debt. The only thing that could help average person on the street is to (hyper)inflate all the debts and start all over. And from that point try to do it better than the last time.

- Not the mention that I could be blamed for taking down $IMFS, single handedly. The $IMFS that is going down for the count just fine on its own.

Also imagine someone pointing at you and saying to the shrimps that you are the reasons there are no more McMansions, SUVs, fancy vacations, Iphones-pads-watches and whatnot? No more soup for you ie. easy credit?

Dante the Insider :-)

Dante,

I am quite satisfied with your answer … thanks!

Bitte schön, glad if I am able to help. :-)

It is my opinion that the reason why very few conspiracy theories ever come to light is because there are very few conspiracies. Secrets never last and when they do come out the more secret it was the more of a big deal people and the media will make about it. Kind of a big down side to super secret plans! So with that in mind is it a secret conspiracy that wealthy old money families understand wealth and pass this knowledge on to their heirs better than other families? No.

An actual oil for gold secret deal written out for all to see and keep secret would be foolish and unnecessary. Most well played schemes are simply a shared understanding. It’s an understood win-win strategy between both parties involved needing little more than a conversation and a handshake. Shared understandings can’t be “whistle blown”, just shared, and usually with little fanfare. For all intents and purposes the shared understanding between the issuer of the reserve currency and the worlds largest oil state was “whistle blown” decades ago by Another. But, since we didn’t come across any secret contracts or captured agents delivering secret gold it went mostly unnoticed.

Another gave us a very plausible explanation that long ago oil bid directly for gold and a few things happened. Physical gold skyrocketed while supply dried up and the world economy was being destroyed. This was a lose-lose for everyone. However a few smart people realized there was a simple way for both sides to save the world economy and get cheap oil flowing again for cheap gold. The plan of action was shared and understood by the interested parties and the rest is history.

The knowledge of what wealth actually is (physical possession) has been understood by a small group of (mainly wealthy) people for centuries. This gives them a huge advantage (at being wealthy) over people that haven’t taken the time to expand their understanding. However, the fact that most people don’t understand wealth doesn’t make it a conspiratorial secret held back from the masses. Like nutrition, physics, and credit scores the knowledge is out there for the world to soak up but few take the time. Contrary to the occasional sales made on books titled “THE SECRETS TO WEALTH THE RICH DON’T WANT YOU TO KNOW!!!!”

Tracking, and taking notes... Though a contrarian by nature, betting against the majority here has risks. ;-)

@Sam

Robert Kiyosaki knows!

Even if some conspiracy existed does anyone think J6P or the MSM would give a hoot? Most people just want cheap gas and cheap beer and affordable cable television,

Well spoken Sam!

Great comment Sam ...

Believing is easier than thinking. Hence so many more believers than thinkers. ~Bruce Calvert

Excuse the off topic guys, I don't know how I manage so often to post at the end of comments section...

I would love to hear your opinion on this:

FOA 10,000$ mention has always meant to me 250 (price of gold at the time) x 40 (reval factor mentioned by FOFOA several times).

It is the multiplier I look at not the absolute value in $; today: 1300 x 40 = 52,000. But maybe the 40x will be applied to the "last" price of gold, maybe 400$? in that case reval price in $ = 16,000??

Now, is tat multiplier 40? or is it 100? (more inline with the paper to phys flow at the LBMA) in this last case, we could get 40,000$.

More or less then between 16k to 130k, geometric mean of 45k (FOFOA also said lately: 20k too little, 200k too much).

Cheers.

ampmfix

You know what they say about opinions eh? Heh

I like FOFOA's comment. Thing is I know one would like to predict an accurate number so you can do number crunching and get to some fixed future figure...I just don't think it is reasonably possible to do so.

[omg i'm soo rich, now everyone else just has to realize it ;) ]

I would say forget about multipliers. It's about the price required by the superorganism to clear and balance trade.

How do we determine that? Well we can set boundaries, but not much more. Individuals cannot determine exactingly what requires the computational power of the whole human superorganism.

That's why the $55,000 figure hasn't been changed. It is symbolic, simply to give one an estimate of order of magnitude.

I know its a burning question, and I know it is human to want to know exactly, but I submit you will have to make peace with not knowing.

TF

ampmfix,

As long as I am able to buy a BMW with 1 ounce of gold, I'm fine with any multiplier. ;-)

@Sam +100

That's for your comment at 8.16am above.

As to your "guess" of E850 by mid-month; no-way! My guess is we'll trundle along sideways and E946 will be the figure announced.

A new low on GLD today at 901.79 vs previous low at 905.99.

ampmfix...whatever number does the job for the world's balance sheet

Dante Eu...or 60 for my Bugatti Veyron (dreaming...)

Michael,

Oh boy, that was a beast! :-)

Thanks MF, DE, MdV! A toyota is good for me...

D E

I used to have a Mercedes CL65 AMG. governed down to 625 HP. It was a 2006 (I bought used natch) and for that year was said to be the number 2 fastest production car (to the Veyron at #1). At a new price of about 118k it did not come close to the Bugatti in price or performance.

I got a (bad) speeding ticket the first day I owned it so in all likelihood I would not really get a Veyron as I want to keep my license and apparently my impulse control is roughly that of a 17 year old....but I dream...

Yeah, those are all some smoking rides, to be sure. I've driven the CLS63 AMG before and, wow. I can see how that class could get you into trouble. :-)

Personally, I will have to make due with the Nissan GT-R Black Edition.

The Veyron, at 2 Million plus per new copy (and a loss-leader for them), is just something I couldn't bring myself to prying out of my stash to buy.

MIchael dV,

At 118k, that Mercedes is worth approximately 50 of my cars.

Bet my fleet goes farther! And if I had that top speed, I'd surely be dead in short order.

Life preservation through economic throttling...another benefit of small means living!

Uber Shrimps FTW!

Cheers

Oh, and instead of a car payment, I just bought another $500.00 of bullion. This month and the next. And so on.

I'd drive a Pinto to keep that deal going!

But on a vacation, I'd pay 20$ to get a picture in one of those hot cars. Man, I'd look cool.

Cheers

bby

I went through a 'phase' in which I had Jags and 2 of the Biturbo 12s.

I've settled into Hyundais now....great cars, all the luxury of a 2006 Mercedes I had in my 2011 Sonata. I'm in a Santa Fe now and will be for...well until I get that Bugatti.

But what about the auto workers' children?

We should all buy a couple of Seats and Fiats each. We're such jerks! ;)

THIS is the 3 Yr historical $IRX Chart ...yields of which are now plumbing the depths of parity ...and in the secondary market, now in negativity...

...all of which is key to the emergence of FreeGold - fwiw.

Just returned from an interesting sojourn in Europe.

In and around Moscow, they will use approx 6 Kg Au every 6 years in maintenance as it washes off the Cupolas / Statues etc. (or so I'm told?)

With the amount of refurb works currently underway across Russia, the total Au loss / annum in that country alone is ...or will be staggering.

In a year or so the works will be complete and Russia will look her golden self again.

@Sam

Re. Secrets never last ...

Exactly. However, I have been wondering for some time why Another/FOFOA's solution, so excellently articulated here, involving physical only Gold at 40X today's value has not leaked out from some institution like the BIS as the planned endgame or at least as plan B or C?

IMHO this solution, which is discussed so much here, must have been discussed and debated and written up in places like the BIS/BoE/Fed/ECB over the last 20 years, so why don't we hear more leaks? Some secretary or girlfriend of some influential bankster in Basel must have heard something and then told her mother etc... etc ...

or ... is this blog the only leak?! Anyway, I am only slightly concerned and do not intend to sell the stack to buy TBonds.

Q1, kicking the can for another 6 months. In April, support then was withdrawn meaning the first half snapshot (Q2) would mark a first low. For the unimportant Q3 another low number wouldn't matter so I'd go for 917 simply for someone needs to go against consenus here, not that it would matter if its higher, it might more depend on current politics and such.

Then it would be 6 months without support, but what then about the important book entries for end-of-year? 500? 2333? Or simply 875?

Sam,

Some nice thoughts there.

As for the "secret getting out" I think it has among those who see its value and are acting upon its consequences like China, Inda and Russia.

All want the favored energy currency and are trying as best they can to "catch up" to the many nations collective gold stockpiles under the Euro system.

There has been much thought given to the horizontal gold flow (i.e. West to East) and maybe not as much to the vertical (i.e. private vs. public, corporate vs. individual) but I think you will agree that gold is flowing vertically from weak to strong, and from "individual and private" to "sovereign and systemic" though in the end it will all end up recapitalizing the banks, as credit (debt) is essential in the correct economic mix going forward, and the senior shareholders of said banks do indirectly own the CBs all the way up to the BIS.

A competing structure is trying to form. Freegold will either happen to prevent that, or as a result of that, in all probability.

ChrisF,

When it comes to the "planned endgame" its not like the BIS knows what the revaluation multiple will be. The BIS does not need to know. It is sufficient for the BIS to be aware that gold will be the anchor of the world's next currency system, and the one after that, and to prepare accordingly.

If I understand the theory correctly, part of the reason FOFOA has suggested a much higher revaluation figure (compared to others like Rickards) is that he predicts a failure scenario that will result in a mass migration of investors becoming savers. If I understand Rickards correctly, we could have a more orderly failure with a non-deflationary revaluation to 7000-8000 ounce that would large preserve asset allocation ratios of the current financial system. Brodsky threw out numbers around 10,000 per ounce, and I think he was expecting an orderly collapse too.

I don't think the BIS knows what is going to happen, but I figure those in the know what considered a variety of different outcomes.

The BIS knows, or at least individual members fully understand the role gold will play in the next monetary system. The world's absolute need for currency assures this fact in my mind. What is the quote, 'Old world money as seen through new world eyes'. The Euro is the currency the BIS will protect and in order for there to be comfort in any mathematician's mind numbers are crunched.

The BIS, in what ever human form you want to imagine, is fully cognizant of Reference Point Gold and they have a very close approximation of the number of Euros it will take to recapitalize the system.

Robert: It is not the migration of investors becoming savers that will spur the rise in gold but instead the need to recapitalize the balance sheets of the Central banks of the world after the dollar collapses and a new dollar is introduced to bid for gold.

or should have read, 'they have a very close approximation of the number of Euros it will take to coax gold out of hiding and thus recapitalize the system with the revaluation of gold already on the books of the Central Banks'.

Indenture,

Two points. First, aren't these overlapping factors? One scenario for coaxing gold out of hiding and finding the clearing price comes in a hyperinflation context where previously self-identifying investors are in a stampede flight to safety.

Second, as Rickards notes, there are different types of collapses. Predicting a collapse is not that provocative because it has happened many times before. There are cataclysmic collapses that may involve gold coing into hiding and coming out at a much much higher revaluation price. But there is also the possibility of a negotiated solution where all the major players work out an altnernative monetary system before we collectively reach the point of a cataclysmic collapse. For example, the central banks could collectively agree to revalue gold to 10,000 by setting a new price floor. That might only be a temporary solution on the eventual road to freegold, but it might be a stop along the trail.

I suspect that the BIS is prepared for more than one path to the end game, but the common feature is all the plans is the central importance of gold.

Could somebody help me with this question: let's say in the past 12 months (or in a typical year in the recent past), what was the flow of physical gold like? How many tons changed hands, and from whom to whom? Thanks in advance.

Franco

the flow of physical is published for countries and central banks. I know of no source that shows secret movement of large quantities. The Gold Council (http://www.gold.org/) would be a good place to start.

"what was the flow of physical gold like?"

imposible conocer

ChrisF

Look at the Euro. It has physical gold on line 1 of its balance sheet. Even with this outright declaration, 100% of the media ignore or speak as though they do not understand the meaning of this fact. In 3 years I have not heard one other source point this out. No one has said 'hey, there is a big difference between the ECB and the Fed'. Sure they mention that the ECB has only one mandate but the enormous fundamental difference is ignored. Sprott, Turk, Sinclair, Faber, Rogers, Rickards...not a single one had addressed this.

With that in mind who needs secrets? If the entire world that claims to be interested in things monetary can't see this enormous difference, well the BIS simply doesn't have a problem with 'word getting out'.

And yes, this is the one and only site that has addressed this issue. (I haven't had time to read everything on the internet lately so correct me if I'm wrong.)

There is a corollary to Gibson's rule. Yes, gold should rise 8% for every percent below a 2% real rate, but what happens when real rates are above 2%? This is place goldbugs cannot look for it dispels the myth of gold acting as a store of value.

The notion that the masses will migrate from investments to saving in a non-yielding asset is flawed and ignores how gold really responds in an inflationary environment.

A quote from TwoShortPlanks: "Take Gold for example; it's not money at all, nor is it a store of value. To me, Gold is merely a store of, a representation of, time, energy and knowledge/Ingenuity...it's value is only derived from a commonly agreed upon (general) acknowledgement of that notional value (an agreement to the terms), the price tag of which must be assigned - as with all things - through price discovery. Fiat paper money too must be commonly agreed upon as representing manpower and energy elsewhere. So, the real issue here is that paper money can act like a Time Machine, actually, more like a Virtual Particle where, time and energy can be circumvented for a brief period, and the fruits of labour and energy can be artificially and magically emulated, but then the natural balance of things must be restored."

Gold and currency take turns as a SoV. When one does the other loses its ass.

If Aaron or Indenture were here, they would say:

"Then there is an alternative site the FOFOA blog. I don't recommend it anymore. The thesis there is that gold will stay external to the system at a price of 55,000/oz. There will be no mining of gold, no gold lending, easy credit creation in a currency will be punished by a higher gold price in that currency. It is bizarre. I post there under GrumpsLabastard telling the cultists there they're full of crap. My name is mud over there."

OBA,

Welcome back to blogosphere from your journey. Always interesting to read a description of your experiences :)

I was just discussing this short term debt thingy with DP on twitter and I was wondering whether money was moving into something else than IRX lately...

Seems that the Euro area short term debt market is actually bigger than IRX. IRX T-bill outstanding debt is ~ $115B, while Euro area short term (central .gov) debt is approx. $777B.

See http://www.ecb.europa.eu/stats/money/securities/debt/html/index.en.html

Could you give us all a refresher why we primarily watch IRX discount rates with respect to FG anticipation? Is it just because it is the most accessible proxy for short term debt, or is it because IRX owns a special place amongst short term debt paper? Perhaps because it is the short term debt paper of the national government of the world reserve currency and one should expect a run toward reserve-currency denominated paper in a collapse situation?

Thanks for thoughts! :D

/BF

Robert: When gold goes into hiding it will not be $10,000 (current dollars) that will coax it out. This current Dollar must die, taking all Dollar denominated debt with it, and only then can a New Dollar bid for gold. A fresh unencumbered Dollar coaxing gold out of hiding at the new price of $xxx,xxx (I agree with Edwardo). In order for Freegold to occur the Dollar must hyperinflate

There will be no negotiated solution revaluing the price of gold to $10,000 because it is impossible to raise the price of gold in isolation until debts are no longer denominated in gold.

OBA, they'll offer unlimited reverse repos at a small positive interest rate to a broad list of counterparties and thereby keep rates positive! Take a look at the paragraph on the Fixed-Rate, Full Allotment Overnight Reverse Repo Facility here (Bill Dudley on September 23).

This will be the lowest level of Exter's inverse pyramid that will be walked by giants. Then, the paths diverge. Domestic shrimps will go for tangible cash and then shopping while foreign giants will leave the dollar altogether.

Btw, these days the window is particularly wide open!

The most elegant way would be for the U.S. to trigger it. Oops. We are sorry, we have to partially default. Hmmm. Which loans do we default on? Sure, let's default on all the foreign held Treasury debt and print out the equivalent of all the domestically held. We do have to protect our pensioners after all.

Alright, now the dollar has full purchasing power domestically, but zero credibility internationally, agreed, and we will have to ship physical gold for all imports. But, hey, after some thorough HI, the situation wouldn't be any different, but this way, we get there right away without all the friction and misallocation of capital that a full blown HI would bring.

Even if the U.S. don't appreciate the advantages of a shut-down government, some accident in the financial system involving both the dollar and gold may easily happen under the present circumstances, no? Who wouldn't understand if some investors panic. Whom do you blame if many start running at the same moment?

Victor

Well said Victor. I like the cut of your jib;

@Grumps

Do you recall seeing in any of Gibson’s data gold leveling off and then falling by over 33% over the course of several years all during a state of real interest rates well below 2%? I don’t. Sorry my friend the bull run isn’t going to suddenly resume and your antiquated charts won’t help you or your mining stocks this time. It’s almost as if there is a change in the air.

Look, the freegold thesis isn’t ignoring your “real interest rates conundrum.” Your concerns are very much debunked throughout the pages of this blog. However, even if you did someday read the blog and then came up with a really great reason why the new monetary system isn’t going to work out (which let me reiterate currently you do not have one) it wouldn’t change a thing. This is not an activist website looking to garner support for a cause. Freegold will happen whether you think it should or not. This blog represents a collection of observers that are simply using a lenses given to us by our host(s) to see what new system has been set up decades ago to replace the dollar, and how we can best position ourselves for the inevitable change.

Thanks to Michael dV for the tip about the World Gold Council, I got the following statistics about Q2 2013:

Supply:

-Mining: 717 t

-Recycling: 308 t

Total supply: 1025 t

Demand:

Jewelry: 593 t

Bars/coins: 507 t

Central Banks: 71 t

Technology: 104 t

ETFs: -402 t

OTC transactions: 152 t

Total demand: 1025 t

I guess the World Gold Council doesn't track gold that is not mined nor recycled but simply existing privately-owned bars that change hands. Anyway, is that flow (existing bars that change hands privately) the one that would go into hiding in the freegold scenario? Is there any guesstimate on the on the size of that flow?

The following might be a repost. Blogger crapped out the first time.

Sam,

You have to look at value, not just price. When real rates are over 2%, gold tends to underperform CPI. This is more apparent in other currencies.

What kind of world is one in which gold exceeds CPI? A good layman's definition for inflation/deflation might be the following. Inflation occurs when the market believes promises will be kept. Deflation happen when the market loses faith in promises. Using that definition how will gold behave during inflation? During deflation?

The assumption that gold is an absolute, constant, store of value, store of wealth is incorrect. That's why all the models put forth by Fekete, FOFOA, the Austrians all fall short of describing reality. It took me awhile to shed this baggage, but the perspective that gold is not a store of value allows one to see gold's real behavior.

After gold is revalued to heal balance sheets, then it will have served its purpose. It will lie dormant at the bottom of the inverse pyramid falling in PP until the next phase of neg real rates.

Picture FOFOA's graph of gold launching into orbit at a new equilibrium price. I'm not saying that gold will drop in price. I'm pointing out what is missing from that graph and that is CPI trending at a steeper slope than gold after the transition if we are to be in a market which believes promises will be kept (inflationary).

If one's argument is that gold is not a perfect store of value, then you are correct. Nothing is.

However, gold is the best store of value. Because it is the best, gold is where economic surplus resides. Gold is the only item that can absorb surplus without the cost of surplus. That is why gold has risen from $35 an ounce in 1971 to $1300 today. We are now more productive than we have ever been, so economists might tell you that we don't need a store of value, and that gold is therefore dead. That all we need are currencies and bonds and stocks. The economists are wrong, if not malignantly misleading. The latter fail, all the time, and quite spectacularly, I might add. Gold never does.

It's just that we have so much energy surplus, that the surplus found its way into stocks and bonds and not into gold (at least not in the spot price that we see). Without the energy surplus, I would argue that the stocks and bonds are not only worth less, but quite possibly worthless.

Once this happens, the surplus doesn't "disappear" it will just migrate into gold as it should have done all along.

This is a natural result of the interaction between human beings and the environment. It's just that we've been tricked for awhile and are now only beginning to discover this.

Franco

'gold in hiding' refers to the lack of a quoted price for gold after a paper market failure.

The gold will all be there (maybe even exposing itself like Miley Cyrus) but if there is no Comex or Kitco who will be willing to buy or sell?

If the last known price was $1250/oz but there is a failure to deliver at that price, then those in the know would realize that the last quoted price was no where near high enough to coax gold out of stable hands. Would you sell your gold for 1400/oz under such circumstances? Not likely with talk of 10,000. 25,000 hell even 55,000 per oz.

We anticipate a period in which you will not know what the rest of the world thinks gold is worth.

Since gold is very important there must eventually be a quoted price. Fofoa expects a buyer of indefinite quantity (ie all that is offered) willing to pay whatever it takes to restart the selling.

Michael dV:

You said "if there is no Comex or Kitco who will be willing to buy or sell?". Wouldn't the miners be happy to sell at any price above their break-even price of $1400/oz or whatever it is?

Sorry Grumps, no credibility here.

"Then there is an alternative site the FOFOA blog. I don't recommend it anymore. The thesis there is that gold will stay external to the system at a price of 55,000/oz. There will be no mining of gold, no gold lending, easy credit creation in a currency will be punished by a higher gold price in that currency. It is bizarre. I post there under GrumpsLabastard telling the cultists there they're full of crap. My name is mud over there."

Was it Gibson, Keynes, or just you Grumps that declares I must look at "value" and not "price" to understand Gibson's paradox? Since you are the authority can you tell me what the *real interest rates have been since 2011? What about the *value of gold. Is it up or down over the last few years?

The rest of your comment has been addressed over and over again so let's just stick to this point if we could.

Michael dV,

"The gold will all be there (maybe even exposing itself like Miley Cyrus)"

LOL

VtC,

I too expect the shutdown and ceiling drama to provide cover for the next stage. Keep the tweets coming, I look forward to them every day.

"Keep the tweets coming, I look forward to them every day."

What tweets?

The most elegant way would be for the U.S. to trigger it. Oops. We are sorry, we have to partially default. Hmmm. Which loans do we default on? Sure, let's default on all the foreign held Treasury debt and print out the equivalent of all the domestically held.

Victor, this doesn't seem plausible - who would ever lend to them / buy T-Bills ever again?

@Franco

https://twitter.com/VictorCleaner

S P,

You are right in that the surplus migrates to gold when the bond market is down to its last telomere entering apoptosis, but this surplus will not stay there. It will be redeployed again into the monetary plane to grow more wealth. It's not that we are tricked, it's the nature of the beast. If you choose to sit in gold throughout the growth phase your wealth will shrink. If you really want walk in the footsteps of giants you have to play the game and participate in this growth phase and when it's time for the house to call in the chips you move back into gold, only you will have a bigger pile than at the start.

If you had 10 oz in 71 and dishoarded over 1980-1982 say for average of 600/oz for $6000 and put this in the Dow for an avg cost of 1000 for 6 shares, then by 2000 you would have 84K in stock. Go back to gold but now have approx 280 oz.

If stayed in 10 oz gold from 71-now then 10x1300= 13K

If rotated between gold and growth then 280x1300=364K

This is what the giants do. They dishoard for growth to end up with an even bigger hoard at the end of the next cycle.

Like a case of herpes, Gimpy's back, leaving sores all over the place immediately after he (or his beacon of silliness) posts yet another literacy challenged, conspiracy laden bit of fools gold on too short on facts.

VTC wrote:

The most elegant way would be for the U.S. to trigger it. Oops. We are sorry, we have to partially default. Hmmm. Which loans do we default on? Sure, let's default on all the foreign held Treasury debt and print out the equivalent of all the domestically held. We do have to protect our pensioners after all.

I have a question for you: What's the domestic debt worth exactly when the foreign debt has been defaulted on?

Alright, now the dollar has full purchasing power domestically. but zero credibility internationally, agreed, and we will have to ship physical gold for all imports. But, hey, after some thorough HI, the situation wouldn't be any different, but this way, we get there right away without all the friction and misallocation of capital that a full blown HI would bring.

I do hate to be a wet blanket, but given that the U.S. chronically imports more, a lot more, than it exports, ponder what full purchasing power domestically will actually mean in practical terms when the dollar has zero credibility internationally As for gold, the point is to keep as much gold as possible. That's why you HI first and revalue once the debt has been erased in real terms.

Sam,

Real interest rates have been negative for the most part since 2000. This was the fuel for gold's rise above CPI. Since Germany asked for its gold, we've now entered the terminal stage of this monetary system. To not impenge on the apparent value of USTreasuries, you know the ESF and also maybe foreign holders are capping gold to 1) get physical cheap and 2) keep dollar holdings from imploding. Treasuries are getting to the end of the rope as far as nominal gains so the negative rate canary must be kept under wraps as long as possible.

Franco

hell I would be willing to sell too...but at what price?

I think the miners will be just like some rich guy who realizes that with no market there is huge risk.

Picture a yourself at a garage sale. You see a 57 Strat and grab it. You are headed to the table to buy when 2 others say 'hey...is that a 57 Strat?"

At that point Auntee Jean who is having the garage sale grabs the late uncle Roy's crapy old guitar away from you and says to herself...I'd better find out what I have here before I sell it too cheap.

If there is suddenly NO MARKET then some may sell but I doubt anyone able to put together say a ton would be so silly.

@burning: - thanks mate ...one of the few pleasures left to we old farts is gallivanting around the World on Frequent-flier points ...cudos Emirates BTW ;-)

I would defer to VtC on all things "mechanical" relative to systemic upheaval my friend, however when one introduces a "time" dynamic ie: the necessity to migrate assets into Here and Now Cash equivalents (<$IRX etc) ...rather than "risking" it into the future - (Notes / Bonds / RE etc) - we begin to understand the real necessity of Gold (24K held close) to players large and small.

Gold is "timeless" ...Currencies ...and those who utilize and manage them aren't ...and never will be.

Nothing epitomizes the "time-problem" more than the extent they're currently going to to mitigate the lack of "faith" in the future via this incessant fiddling with the yield-curve (per VtC's reference).

Sooner rather than later, the Hat that has the Rabbits in it will be empty methinks.

Indenture,

My message must not have been clear. I did not mean to suggest that $10,000 or a negotiated agreement would be sufficient to coax gold out of hiding AFTER the paper gold market freezes up. The suggestion was that these things might happen BEFORE the gold market freezes up, and to keep the gold market from freezing up. I do not understand why you say that it is impossible to revalue gold as part of a negotiated agreement. It seems the mechanics of how that would happen are straightforward. At least Rickards and Brodsky seem to think so. If not, perhaps you (or FOFOA) could explain why?

Grumps make the mistake of thinking that there's yet another economic cycle just around the corner, and once gold goes high enough and interest rates go high enough, this will force the dishoarding and you can safely go back into currency and hold stocks and bonds for the long haul.

This happened once, and just once, in the early 80s. There is absolutely no evidence that this is a recurring theme. In fact I would argue the opposite: that we are entering the black hole of zero growth, more or less permanently. Throw away all of your economic textbooks. The world has a tremendous surplus of people, debt, and energy, and once these decline, they will never come back again. The "wealthy" of our world have managed to capture the value of this surplus. It is what it is, I don't begrduge them. My own parents have done reasonably well.

But the game is ending before our very eyes, and not 1 in 1000 people have the wits to see it.

Robert,

Since the price of gold currently is correlated with many other commodities, running the POG to $10,000 without breaking the correlations will have what effect on the price of, for example, oil?

FOFOA: This brings me to why gold stays correlated with oil and silver and everything else. It is not, as some people believe, a manipulation run by the USG intentionally stirring up trouble in the Middle East. It is because of something very similar to Mises' Regression Theorem. Correlated commodities are correlated today because they were correlated yesterday. And they were correlated yesterday because they were correlated the day before. As long as they trade in relatively free and open markets, their ratios or correlations will not change quickly.

Why? Because traders expect them to stay correlated due to the Regression Theorem and therefore they (the traders) act on that expectation. We normally call this arbitrage, but it's more of an effect of the Superorganism than it is the individual act of a conscious "arbitrageur".

So in this case, all of the publicly traded commodities in the world constitute a weight around gold's neck holding it under water. If the gold bugs try to drive gold higher in isolation, the rest of the trading world will see a profit opportunity in selling gold and buying whatever their favorite correlated commodity is. This will keep gold correlated with all of the commodities it was correlated with yesterday. And if those commodities are not ready to explode in price, then neither will gold. The only way we get $3,500 gold is with $230 oil and $70 silver. And that's not a revaluation. That's either a commodity bull run or inflation.

The paper trading arena prevents physical gold from finding its true value as a monetary reserve asset because it chains it to commodities. In my Snapshot Day post I made the point that, among the CB monetary reserve assets, gold fluctuated much more wildly than the others. That's because it is chained to commodities. It can't break free until the physical flow runs out. Then it will break free and there'll be no more paper gold market for the traders to "arbitrage" between gold and commodities.

Traders that believe gold is overvalued at $55K or whatever will have no say in the matter. They won't be able to short it and buy up their favorite correlated commodity anymore. Gold:Whatever ratios will become meaningless, because the rest of the commodity world will continue trading in paper.

S P,

The 70's run was a Summer phase when CPI outpaced bond rates. What we have now is Winter Debt Saturation. Savings are already in the burning barn. High rates this time will signal default. After the credit crunch is allowed to take its natural course and purge the debt, then normalized rates should actually start out low, but CPI will be low as well. The world is not going to end. We can't grow b/c the debt load is too big. The Custodians want to hold off on devaluation until they milk the collateral calls for all they can, to reconfigure the geopoltics to their liking. Then the game of human farming will start anew.

RRTFB is a great help, especially in chosen bits, thanks Jeff. Another aha for me.

I watched POINT OF NO RETURN kast night, where they brought in the cleaner, Victor, to deal with Bridget Fonda (a task I would have volunteered for, but not in the way of Keitel). This movie of course predates Tarantino's PULP FICTION homage ...

In April, many predicted October would be "the month" of many changes.

One change I see is the dysfunction of the USG being made more "public". Perhaps its a gesture, or a sign, that "just sitting back and waiting" is indeed the best thing to do.

After all, all the action is across the Atlantic.

Happy Trail!

- R (a.k.a. Wil)

Oh, and I don't recall the post but it was discussed not TOO long ago, the one where FOFOA talks about the debt based system transforming into an equity based system. It may have been his best (IMHO) but the one that really rocked me was the Hyperinflation post regarding the "Bond Salesman" one of the just another HI's.

JR could pluck them from the index instantly,

Cheers

And for all the smokers.....24K gold rolly papers!

http://www.dailymail.co.uk/femail/article-2439011/Would-smoke-cigarette-24K-GOLD-The-65-rolling-papers-hot-new-thing-smokers-money-burn.html

Who would have thought??

shinepapers.com

Thank you Jeff. Correlation and Regression Theorem.

Spot on. Once this is understood all thoughts of gold going 'to da moon' in current dollars vanishes as a possibility.

Robert: I hope this helps.

Jesse's "correspondent" is talking Coat Check Room.

On the mass exodus of gold

Maybe Jesse can quit grasping for reasons why physical gold bullion is leaving the paper gold markets? He better hurry, at some point the remaining gold is going to go poof and the why of it won't matter anymore.

Matrix,

They steal the term but fail the analogy. The coat check room is more about "layers of flow" than fractionalization. Not that rehypothecation is irrelevant, but there are better analkogies for it, if analogy is the tool you wish to employ to facilitate understanding.

And now I see by the clock on the wall that it is time to begin the drunken debauchery early for this weekend stretch. Working 2 jobs for 90 days plus just to be able to battle debt and inflation is tiresome, and single malts await.

Yesterday at Jesse's it was noted that silver behaved more like platinum and palladium 'even though silver is the poor man's gold'.

Slowly it is dawning upon them that...well shit eventually they are just going to say..'holy crap fofoa was right'..

For now they have chosen a different path to the truth. They will eventually get there but it might be too late to profit.

Fofoa's guide: How to Profit in the Future, Buy Gold

is not the easiest read but many have made it through and are content with their positions. It just seems that all these other great thinkers have not taken the time to consider what is already written. They have started with their baggage and only slowly put it down.

Major lolz for the Fofoa brigade this afternoon over at MarketWatch: "Why Uncle Sam is Hoarding Gold."

http://www.marketwatch.com/story/why-uncle-sam-is-hoarding-gold-2013-10-04?dist=beforebell

snip:

"It’s silly, nothing more than a shiny metal, a substance with little use and little real value, a “barbarous relic,” and the stuff of nothing more than superstition. Only a fool would own any gold in his portfolio.

Right? . . .

There is just one nagging problem with this story line. One group of people disagrees. And I am not talking about wacko gold bugs in Arizona (“the ex-husband state”) with tinfoil on their heads.

I am talking about the people running the United States Treasury.

They remain firm believers in gold. Big-time.

This week I asked them if they would consider selling some of the country’s gold reserves to pay the bills if the budget crisis escalates later this month.

Their response? Not a chance.

The Treasury has considered that option, among the many others, and rejected it. “Selling gold would undercut confidence in the U.S. both here and abroad,” a spokeswoman said, “and would be destabilizing to the world financial system.” She was quoting an official position laid out last year in a letter to Senator Orrin Hatch, but so far apparently little noticed on Wall Street.

To get the full measure of that statement, it is worth reminding ourselves of where we are now. The government has already shut down and there is a non-trivial risk that in just over two weeks it may actually default on its debts. I’m not saying it’s likely, but I am saying the risk is real. To prevent that happening, Congress, which can’t even agree to keep open the Bunker Hill Monument for tourists, must agree to hike the debt ceiling. If it doesn’t, the federal government will quickly run out of money.

The Treasury has considered various scenarios and contingencies, officials say. They have concluded that delaying government payments across the board—from Social Security to debt interest — would be the least harmful approach.

In other words, according to the official position of the U.S. Treasury, the promises and commitments of the government, and its “full faith and credit,” are actually worth less than gold. They’d rather default than lose their bullion."

end snip

And don't miss the most excellent advice at the end of the article to buy shares in the Central GoldTrust. You can save taxes big time because the shares are taxed at a lower capital gains tax than the cap gains tax on bullion (20% vs 28% if memory serves)!

Happy weekend to all, and thank you all for the continuing education and discussion!

From Jesse's 'Coat Check Room' link above:

"Similarly, the Cyprus bail-in math (10 tons of Cypriot gold for $10B from ESM, IMF) would suggest that physical gold collateral is worth $31,250/oz in a crisis and that most, but not all, market participants are discounting it because it is such an extreme number."

Anyone ever hear these specific numbers before?

OBA,

Thanks for your reply!

The way I view it right now: Let's watch issues pertaining to the time-problem (signs of rushing to here'n'now). Where (=the type of paper essentially) this rush will eventually manifest is subordinate. We can't tell beforehand because of the "fiddling"...

I'm afraid the "hat" wont be empty before savers/investors stop jumping from one paper to another. Issuers of any paper can always influence the attractiveness of same paper/other paper by fiddling...

We watch!

@Indenture, I have never seen that number posited anywhere, before. It looks like a lowball by the IMF/ESM of 50% or more. But I have seen another number $32k/$64k per oz presented as a What-If. This is from watching a Youtube video by belangp. One of those done within the last few months. He acknowledges knowing about the Freegold thesis.

Nice find Sir T!

Apparently the UST had a plan for selling gold back in 2009 but it was scrapped when polling showed it was unpopular. :D Have a nice weekend!

Gary,

who would ever lend to them / buy T-Bills ever again?

Would that be any different after HI? Why?

In practice, we had a couple of defaults during the past decades (Argentina, Russia, etc) and it turns out people do lend to them again after a few years - with varying success, but nevertheless they lend. AG, of course, we would expect that the CBs sterilize most of the cross-currency area lending of currency denominated paper.

Archer,

What's the domestic debt worth exactly when the foreign debt has been defaulted on?

The Fed could purchase all domestically held Treasury debt for base money while the Treasury declares all foreign held Treasury debt void. There will be borderline cases and serious arguments, but they'll experience some serious friction anyway.

That's why you HI first and revalue once the debt has been erased in real terms.

Or you simply default on the external debt and even get away without HI.

OBA,

Nothing epitomizes the "time-problem" more than the extent they're currently going to to mitigate the lack of "faith" in the future via this incessant fiddling with the yield-curve (per VtC's reference).

Agreed. They are working hard to set up a wide and well-lit escape route for all the T debt. Protect the debt nominally, but let all the rabbits escape abroad.

Victor

»Investors are taking notice of our political dysfunction, and we’ve been quite busy this week with clients buying gold and silver as safe-havens. Just about everyone has cited the craziness in Washington as a contributing factor to their investment decisions. Prices don’t really reflect that heightened physical demand yet, and I think that is attributable to selling in the paper market as investors hunker down to see how this all shakes out.«

USAGold

@Sir Tagio --> Interesting article. Amazing how foolish those people in the comment sections are. For a minute I was tempted to register on the site and give them some whathaveyou, but thought better of it -- let them be hoisted by their own petard. The information is right in front of them, they're just looking at it completely the wrong way.

From a "watchers" perspective, Next weeks T-bill auction could prove "interesting" ;-)

One might think the on-going "debt-ceiling" issue will exacerbate concerns re: faith-in-the-future ...so much so that it will be manifested in the Auction result.

Whilst the thing can't be bid at parity or below, a .005% result with strong Bid-to-Cover (>4.75) will set the lips a-flapping methinks.

Good open discussion and links, lead off by FOFOA!

Events are moving so fast that "news" becomes old, if it wasn't old to start with LOL.! But as Another said, in gold, old will become new.

But to start off the weekend, and because Jesse has been mentioned several times in the thread, a fresh link going even further than ever, because Jesse is expressing FOFOA's viewpoints much more closely (and those of Jesse's friend):

http://jessescrossroadscafe.blogspot.com/2013/10/gold-daily-and-silver-weekly-charts_4.html

Bix Weir has an interesting interview with Kerry Lutz over at Financialsense.com, in which he discusses the conversation he recently had when he called the Treasury Dept asking about the delay in the $100 bill, would it recur, and other questions. They answered him, even said that (they said) new bill would have one update (from it's original 2009 version), and that all else would remain, including 2009 date.. Two golden features pertaining to Congressional authorization - the Declaration of Independence excerpt in background gold lettering and the golden inkwell and bell- are described, and Weir's suggestion that the bill "update" may be related to printed "Federal Reserve" change or omission of some sort on the bill's lettering!

As always Bix says to buy silver, although conversation is on gold exclusively.

Victor,

The critical item in your "default externally" scheme is knowing to within a reasonable tonnage how much gold is going to have to leave U.S. shores to pay stiffed former creditors and prospective repudiators of the currency of the realm. There would need to be a comprehensive cost benefit analysis, as in political and financial costs-costs which are, to some large extent, inextricable, before heading down the road you suggest.

Indenture, that number seems a tad low to me, but, more importantly, did Cypriot gold ever leave the vault? Jessie peddles some strange notions. Here's an example:

As you know I tend to mark the realization that there was a serious problem with the request from the Bundesbank for the repatriation of German gold that was refused and deferred for seven years by the Fed.

The Fed has nothing to do with it as they own no physical.

For review and comment:

http://beforeitsnews.com/new-world-order/2013/09/recovering-buried-gold-in-the-philippines-and-indonesia-chinese-bankers-and-corrupt-federal-government-120.html

Disclosure: I have no agenda other than learning Truth.

I exchanged all my fiat currency for metal years ago.

Okay, let's see what the GLD status is and where we are:

GLD remains on a SELL that began 01OCT2013:

SELL below 125.83 STOP 127.34 TARGET 1 121.57,

TARGET 2 114.51

Weekly continues to confirm with a TARGET 1 of 122.10

I did enter puts on GLD 02OCT2013 and am down 8% on that position.

TLT is on a SELL from 04OCT2013:

SELL below 105.06 STOP 106.32 TARGET 1 100.98, TARGET 2 100.09

Weekly has not confirmed

No Position

Pd and Pt have been batted around like a Pinata on Cinco de Mayo. Tracking but no positions; other than physical from some time ago.

Phat Expat : sorry to say - you are displaying your trading acumen on the least receptive audience ie FOFOA blog . No one here cares for these trading ideas, except that most here think GLD is just going down. There is is a saying - like a dog barking at the sun (meaning will the sun care ???)

Biju

It's not about trading acumen, it's about watching and attempting to divine the moment GLD goes belly up. Or are you saying GLD isn't important in the grand scheme of things? That's the primary reason I post these numbers. To me, it's no different than making a wag/swag on what the price of gold will be at the end of the year.

I don't comment on your posts, as tempting as it might be, I even let the one about purchasing real estate as some kind of short on the 30 year bond go; though it did make me smile. Each to their own I guess.

Though we don't have all the details, when will this madness end? Man sets himself on fire on the National Mall

I wanted to post something yesterday related to what I have been observing in society and the predictive ability of these 'trends'. If we are to look anywhere for the emergence of FG, it will very likely be observed through a societal lens. We are seeing this devolution on a daily basis, and it appears to be picking up speed. And it's not just happening in the US, it is global (to varying degrees). How much stress can people take? Hopefully our leaders aren't just callously observing this and have a plan to care for those that have been cast adrift and abused by this system for the longest of times. I remain cautiously optimistic...

@Archer:- Strictly speaking you're correct HOWEVER it ultimately comes down to Possession (on the one hand) ...and Entitlement (on the other)

Gold Possession ...or Gold Entitlement ??

If you can't have both, then Possession would be just dandy eh?

Here's an interesting chart.

http://www.gordontlong.com/Tipping_Points-2012-Q4/10-25-12-US-MONETARY--US-Nominal_and_Real_Long_Term_Rates.png

What's up with the window? Is it still open, wide open or maybe closing? What are your thoughts?

Steve,

I'll go with wide open.

However it sure appears support is coming into the paper gold market that is keeping a full blown implosion from happening.

GLD is still bleeding bullion. QE continues. US government is shutdown. A bumbling POTUS has emboldened his political opposition. The latter is a very dangerous situation IMO.

What's up with the window? Is it still open...

FoFoA posted in the article:2013 Year of the Window on January 1st:

...it's game on for Freegold meaning that the window of opportunity is now open because official support for paper gold has apparently ended.

What has changed.

On the day of that posting GLD had 1349.92 tonnes

Yesterday, Friday, October 4th that total was 899.99 tonnes, approx 450 tonne decrease.

On January 1st, 2013 the spot price of gold was $1650.00, Friday`s close; $1311.20 - approx $340.00 per ounce decrease.

From the article (quote by Ari):

...timeframe that commences mid- to late 2013 and into early 2014...

For the past half-decade, many international policy stirrings gave every indication to me that 2010 was to be the targeted year for assertively rolling forth the freegold paradigm. But as I've said previously, I feel that the ongoing financial crisis that began with the subprime fiasco has caused instability of such magnitude that the central bankers have been forced to delay briefly and "play it safe" -- one does not dare rock the boat (if there remains any choice in deciding the matter) when the financial waters have become so turbulent and choppy. As for the new timeframe, I'd say that the reported EU plan "to make private bond holders shoulder some of the pain from any sovereign debt restructuring after mid-2013" is as good an indication of a benchmark as any I've seen.

Thanx, just the two commenters I had in mind :-)! For a long time just sitting in the back bench I rtfb, rrtfb and (all) other trail material available. Now and then I'll join the forces so to speak.

Wouldn't the number of GLD shares outstanding also drop as physical is drained from the fund? I would watch the NAV drop below the 0.40% decay rate for signs of default. In theory the fund could go down to 9,653 oz and have only 100,000 shares outstanding.

0.996 to the ninth power is 0.9645, very close to the 0.96537 NAV oz per ten shares. The fund is one month shy of nine full years of expenses.

http://www.tfmetalsreport.com/podcast/5124/jim-willie-discusses-bon-bubble-part-ii Jim provides numerous observations, anecdotes and background supporting FOFOA's timeline. Like other insiders, analysts or whistleblowers etc posted here. I have more, much shorter audio clips coming today I will try and post. We may be mere days away from knowing much more still about freegold or the fate of the dollar. BTW Jesse has echoed FOFOA's theories substantially in two consequitive posts, the second of which I posted a few days ago in this thread.

This short comment from Jim Sinclair is interesting to say the least, on GEAB (Global Anticipation Bulletin) www. LEAP2020.eu brief excerpts, with almost as specific committments to dates as one could possibly get, for what they're worth: http://www.jsmineset.com/2013/10/04/in-the-news-today-1668/

Readers of this blog can skip the main, lead-off Ft. Knox story by Greg Hunter here http://investmentwatchblog.com/world-bank-all-gold-in-fort-knox-is-leased-is-no-longer-included-in-reserves/

- controversial assumptions about what gold remains in US control, it's location, nature(good delivery bars, "deep storage" gold, mines etc.) which FOFOA and commenters have diagnosed well. Scroll instead to the three short news items below it. The last of these is a Youtune audio from an insider, retired government employee with many connections and motives to be sincere, which are evident in the audio and in the written Youtube comments which constitute some of his responses. There is another video(audio) posted by him that occurred just before, and one just after. 3 total at Youtube page http://www.youtube.com/user/WebFraudSquad?feature=watch (Dr. Bill H. Weld)

This Dr. Bill that reminds of "pastor Lindsay whatever" or the poor late Bob Chapman, is unsmokable. They all seem mentally ill.

So the US gov wants the stock market to go down???!, they want the dollar to go down, which is opposite from what this Dr. well-connected-genius says. Every time I hear "my sources told me..." I just turn off. They are just opportunistic grifters, like the wild west snake oil salesmen... just pisses me off...

Do any of you have any thoughts on the decline of America Gold Eagle and Buffalo sales since May of 2013 as reported by the US Mint? Obviously it coincides with the drop in price but I am surprised that the numbers would drop off the cliff like that. I had hoped western private physical demand would continue to be somewhat strong.

Personally it is my opinion that this shrimp demand in the west really means very little but I am curious what others think. I agree with FOFOA that freegold is a top down transition and so demand for physical in size must still be high or higher than mine and recycle supply leading to the draining of GLD.

Hi Sam,

I enjoy your posts.

Do any of you have any thoughts on the decline of America Gold Eagle and Buffalo sales since May of 2013 as reported by the US Mint? Obviously it coincides with the drop in price

I don't think I believe those numbers - they seem way out-of-whack and I don't think Spot price has anything to do with coin sales at all (despite Mr. Sprott always bringing it up - like it should affect the paper price).

I had hoped western private physical demand would continue to be somewhat strong.

Why, Sam?

Personally it is my opinion that this shrimp demand in the west really means very little but I am curious what others think.

I have a feeling very few westerners will want anything to do with Gold as the (paper) price drops ($1000, $900, $700 etc.). Miners will be crushed - few left in business and financial advisers won't even mention the AU word (you mean, kinda like usual?) Many of us who have been encouraging friends and relatives will look like a**holes in this time period. I wouldn't be surprised to see Mr. Buffet trotted out to proclaim Gold a dead asset - reminding us of his past statements. Money might be hard to come by (the DEflation before the HI). PGAs will buy, till we can't anymore - the economy will worsen and few will care about Gold - they will have their own problems. This is the scenario that I mentally prepare for - although it is surely only a guess.

Hi Gary

I enjoy your posts as well.

I doubt the US mint would falsely report how many eagles and buffalos they mint. Perhaps it's my anti conspiracy bias on a "cost of getting caught vs benefit" analysis at work. Logically though why report Aprils's record numbers when that couldn't have been to their benefit at the time. Anyway I did like your comments after that and i think they are right on. As to why I had hoped western private physical demand would continue...I guess I wanted to think more westerners had become physical gold advocates putting even more pressure on the $IMFS and ushering in freegold faster. Again, maybe western shrimp demand is pittance and doesn't matter in the grand scheme of things.

Come to think of it FOFOA has always said to buy as much physical gold as your understanding allows. Almost every gold owner I know that hasn't walked the trail is weak hands obsessed with the currency price. They therefore aren't constricting of long term flow and do not contribute to ushering in freegold at all.....agreed?

Sam,

Purely a personal opinion and anecdotal, but I am sad to say that I no longer believe any official figures.

We here in the US have seen a dismaying slide toward complete propaganda on many fronts. As a result, official information must be vigorously vetted these days. We are unfortunately being lied to on a regular basis.

So, I don't place a lot of weight on "official figures." The Eagle and Buffalo sales may have slipped, or maybe numbers are shmoozed.

Who knows?

Cheers

maybe the weak hands that bought coins during the bull run are now selling after a big price drop and supplying the market enough so that new minting isn't needed. If April's 300,000 plus ounces was an all time record that is less than 10 tons. GLD has lost 400 tons this year. I think we are talking about little league here.

I would not be surprised if demand is down. I think people finally have stopped expecting the imminent resumption of the gold bull market. The price is going nowhere and they are losing interest. Another said that Westerners will not hold assets that aren't going up in value. He's right. Only those of us who really understand that gold should be measured in ounces rather than dollars are still buying.

Hi Sam,

I didn't mean to suggest that it was some sort of planned evil conspiracy - only that I thought it was inaccurate reporting, as in an error. So I took another look at the US Mint site:

Buffalo Sales (ounces)

January 72,500

February 11,500

March 11,000

April 37,000

May 12,500

June 17,000

July 18,500

August 10,000

September 10,000

Eagles (ounces)

January 150,000

February 80,500

March 62,000

April 209,500

May 70,000

June 57,000

July 50,500

August 11,500

September 13,000

Yes, August and September seem pretty lean... 209,000 ounces of Gold Eagles sold in April and 13,000 in September? 6.2% ? and even less the month before! - WOW. Could sentiment be drying up already? I guess so. But, again, I try not to put any FG value on those numbers...

...I guess I wanted to think more westerners had become physical gold advocates putting even more pressure on the $IMFS and ushering in freegold faster

I believe these events are mutually exclusive. 0.8 tons or 7.1 tons / month - it's peanuts in the grand scheme.

Almost every gold owner I know that hasn't walked the trail is weak hands obsessed with the currency price. They therefore aren't constricting of long term flow and do not contribute to ushering in freegold at all.....agreed?

If I read you right - again, irrelevant to FG. I don't perceive FG as initiated at shrimp level but at Giant level and trickling down to us.

Whatever force inhibits westerners to appreciate Gold (and love USDs) is a powerful one. We PGAs are a rare species in the west.

Funny, a friend emailed me the other day and used the same term as you "ushering in Freegold". Maybe it is just me - the only thing I see as a per-cursor to FG is the paper collapse of Gold, which will run concurrent with many other financial events - but it will be the indicator that is easiest for me to use as my barometer for FG's immanency.

Best,

"immanency"? bad word Ughhh - try imminentness - not great but will have to do :)

Thanks Gary. We are on the same page. If you were royalty I would say we are in agreeance your immanency =D

Why are you guys worried about investor demand for gold? As I often explain to the paperbugs, gold revaluation will have nothing to do with shrimp demand. Notice I said gold revaluation, not FG.

Zebedee,

Haha, gotta love the 24K rolling papers. I like how they're $55 a pack;-)

That's what I call Stoner Rock

Sorry, here you go Grumps

http://www.dvdbeaver.com/film/gand.htm

Best,

GT

Dr. Weld, Dr. P.C. Roberts, Karen Hudes, John Williams, Peter Schiff, Gerald Celente and others with government experience, are warning of a possible gubmint October surprise in the markets. Of course, instead, a black swan resulting from incompetence, mismanagement, derivatives, financial and housing asset bubbles, capital destruction, market dislocations, illiquidity, domino defaults, dollar or Treasury market panic is possible. A rogue IT hacking attack, a war in the ME, a solar flare induced infrastructure failure etc. also qualify. Rick Rule is even into 100% cash now: http://www.silverdoctors.com/rick-rule-leveraged-gold-longs-are-heading-to-the-sidelines-in-fear-of-an-october-financial-panic/

Re: "Sam said...

Do any of you have any thoughts on the decline of America Gold Eagle and Buffalo sales since May of 2013 as reported by the US Mint? "

The Mint underwent a change of rules this year which allows them to produce far less coins. The law had stipulated that the Mint must produce the coins "in quantities sufficient to meet customer demand". Now the Mint Director can oversee production in numbers that he determines are enough. Not just avoiding embarrassing delays and suspensions such as were common for the fractional gold Eagles and silver eagles, but eliminating any canary in the coal mine indicator that mintage figures may have yielded to salespeople, speculators, dealers etc.

Gary/Polly

The mint released a special "reverse proof buffalo" on August 8, 2013. It was available for only one month. The mint said delivery would not take place until September 8, 2013.

I bought one of those buffaloes on the first day they were released. I checked the mint website several times in August after that, and the website listed the total number of reverse buffaloes sold to date. The number was updated weekly.

The last number I remember seeing was somewhere between 30,00 and 40,000 reverse proof buffaloes sold during the one month period. My recollection was that this was the number in the third week of the sale

I don't remember the exact number, and don't know if those numbers are still available on the mints website.

I am not into numismatic coins, and simply love the buffalo design. However, I was kind of paying attention to the number sold, since this was an anniversary coin on sale for only a very limited time.

So.....the numbers listed above sure don't reflect the reverse buffalo sales. Would they be reported somewhere else because they are not the standard buffalo?

Any one else purchase a reverse buffalo and remember the number sold?

I just checked the mint website and it indicates that 47,836 reverse proof buffaloes were sold during the one month sale

http://catalog.usmint.gov/webapp/wcs/stores/servlet/ProductDisplay?catalogId=10001&storeId=10001&productId=17144&langId=-1&parent_category_rn=10111

People like to view things that support their biases. But the facts are what they are.

There is something very odd going on with regard to the inventory of gold bullion available for sale, that does not square with its sharp decline in price.

Jesse sees a trail clear and clean that leaves the cluttered main trail. Will he take it?

Michael3c2000 wrote,

Rick Rule is even into 100% cash now

I'm ruling Rick out.

"Almost every gold owner I know that hasn't walked the trail is weak hands obsessed with the currency price. They therefore aren't constricting of long term flow and do not contribute to ushering in freegold at all.....agreed? "

The 'Trail' leads to the inevitability of Dollar Hyperinflation, Dollar Death, and to the creation of a New Dollar bidding for gold. Those interested in the current currency price of gold have yet to ponder the demise of the Dollar.

Anyone new to the ideas incorporated in Reference Point Gold should read JR's Suggested Reading List:

http://matrixsentry.files.wordpress.com/2012/01/jr_s-suggested-rpg-freegold-reading-list2.pdf

Find a nice chair, your beverage of choice, and relax with the 'Flow'.

Thanks Lisa!

That would certainly add credibility to the numbers...

I wonder how they were excluded from the 'official listing' (or main listing that has been quoted around the Net)?

Interesting although more data to throw out the open window of importance. :)

Cheers,

Gary

When solving equations sometimes more than one solution is the result. Some answers are real, some imaginary. If the math applies to a real world problem, imaginary solutions are discarded. Gold revaluation is the real answer. This FG concept is the imaginary solution. It can't exist in the real world.

Let's say gold were to be continually revalued by CB's so as to stay above CPI, what kind of world would that be? ......Wouldn't it be like the world today with an artificially supported bond market?

http://www.youtube.com/watch?v=HpwukCdt5AM

Published on Oct 3, 2013